MF3d/E+ via Getty Images

Background

SES AI (NYSE:SES) is a producer of Lithium-Metal battery technology and various platforms to monitor and create these products. With a strong history of vertical integration and reliable third party tests SES AI looks like a battery contender in this very competitive market. In the past, I have focused on companies such as QuantumScape (QS) and Solid Power (SLDP) as they have been the preeminent leaders in the emerging lithium metal battery industry; these are the most competitive technologies that electric vehicles could use for the foreseeable future. The traditional Lithium-Ion batteries are flammable and have a very negative carbon footprint. Lithium-Metal batteries offer a better solution that doesn’t compromise technological efficiency for the greater communal good.

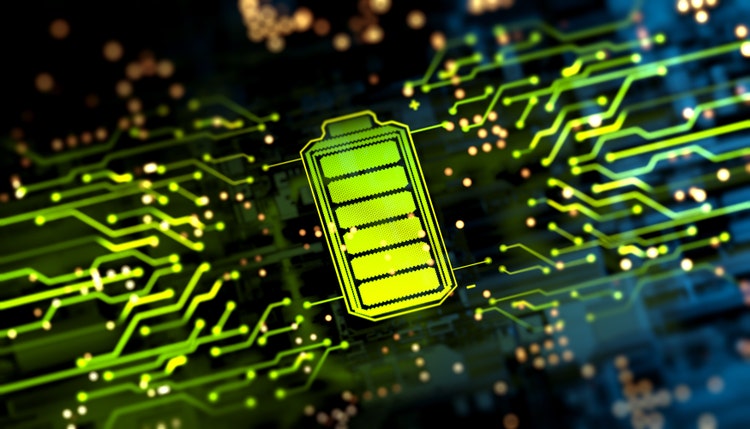

SES AI Investor Presentation March 2022

Source: (SES AI Investor Presentation March 2022)

Lithium metal technology has been one of the primary reasons many battery startups have popped up. This rapid increase of interest is due to many innovations by universities, professors, and doctoral students. These people have wanted to start their own company but can’t until they receive institutional funding. Along with this, the battery industry has become stagnant due to Lithium-Ion producers not looking to differentiate due to their product moat. The batteries are lighter and can support vehicles that operate in a more extensive range of environments.

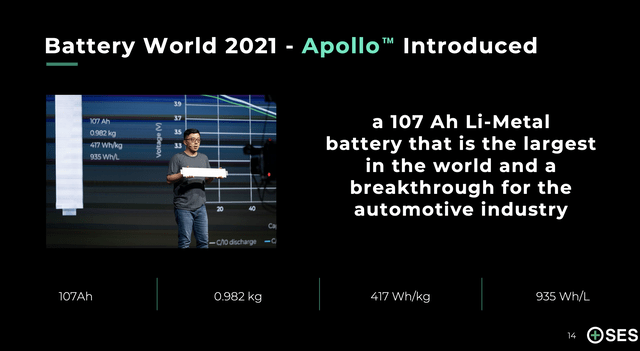

Apollo has Good Prospects Given Research and Results

SES AI Apollo is the flagship battery product for use in electric vehicles. There are a variety of manufacturers that have already signed deals with SES AI. These companies include General Motors (GM), Hyundai (OTCPK:HYMTF), Honda Motor Co. (HMC), Geely (OTCPK:GELYF), Tianqi Lithium Corp [SHE: 002466], and others. This impressive lineup has led to many technological advancements due to access to technology and facilities that these major OEMs can provide a smaller battery startup-like SES. Even though the company is now achieving scale, they have to commercialize the Apollo battery successfully in markets dominated by Lithium-Ion technology.

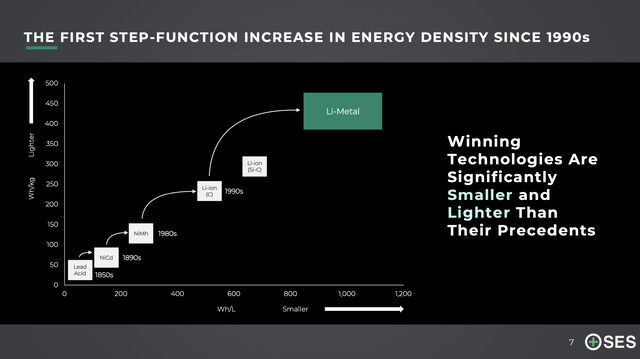

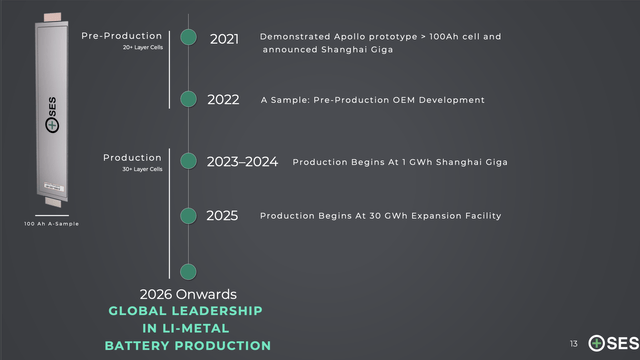

SES AI Investor Presentation March 2022

Source: (SES AI Investor Presentation March 2022)

The Apollo is a marvel in battery technology and offers automotive companies a competitive option over the other lithium metal batteries. With the highest commercialized Lithium-Metal capacity at 107ah (amp hours), SES AI has the key stats that will drive OEMs toward their technology and away from the more established players. SES can also snipe away key OEM contracts from other battery startups because there has been no commercially viable all-solid-state lithium metal cathode. While QuantumScape managed to create an anode-less battery, there are still small band-aids for the key cathode problem. There are two main end components in a battery that conduct usage and charge. To explain these concepts, it’s easiest to go back to battery 101. The battery discharges energy when the cathode is positively charged, and the anode is negatively charged. The opposite is true when the situation is reversed. When the cathode is negatively charged, the battery and the anode are positively charged. With Lithium metal batteries, some manufacturers have been forced to replace the small fundamental battery components with various technologies. This is one of the key reasons battery space is currently the wild west. There is no definite leader, and even though there is a robust OEM presence, scientists at top companies have been experimenting with this problem for a long time. SES AI is in a unique space given these concerns, and with their technology, there is a chance that SES AI could continue to make significant splashes in the battery industry.

SES AI Investor Presentation March 2022

Source: (SES AI Investor Presentation March 2022)

The time for pre-production and production is faster and potentially more commercially viable than other leaders. With production at the shanghai Giga factory plus other Giga factories in talks, there is a massive commercial effort to push out SES batteries. Due to the company’s deep financial connections to the international market, there is an opportunity for scale in places other major manufacturers haven’t been through penetrating. This mass viability and capacity will show itself when production starts. With that, there are a variety of technologies to be excited about as the company is building the production pipeline while also building out its technology.

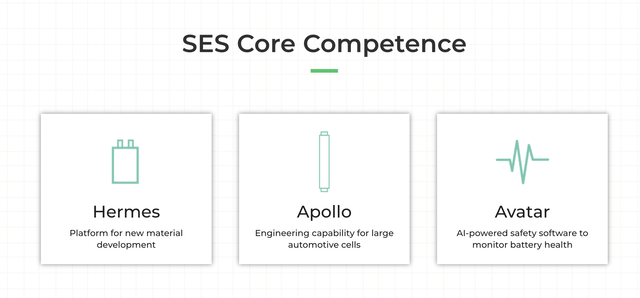

The Product Portfolio has Shown Advancements in Other Areas

SES is not just a one-dimensional company. The company offers a variety of products to support themselves vertically. There have been a variety of innovations and changes during the company’s existence. Since SES AI’s inception, the company has been committed to battery excellence in finding ways to advance the industry into a more suitable and efficient future.

ses.ai Website

Source: (Ses.ai Website)

SES utilizes machine learning and other computing techniques to optimize battery technology and manufacturing processes. This is where Avatar and Hermes come into play, Avatar is an AI-powered software that monitors the health of the batteries over various cycles and temperatures. Even though SES AI uses in-house software, it has been tested by outside universities and research institutions and approved for peer use, and this is an indication that SES has the potential to be a significant player within that individual market as there is always room for new startups to make crucial new battery technology and monitor their findings in the best possible way. Another core competency of SES AI is Hermes. This is the platform that SES uses for new material development in batteries. This is where SES conducts most of its search on finding lower-cost alternatives to make lithium-metal batteries a part of the foreseeable future. The company has made significant progress, and all of the core competence will prove to be substantial boons for the company moving forward.

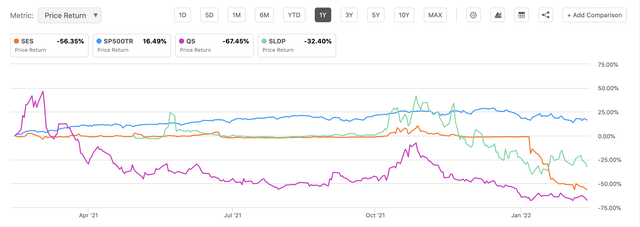

Risks are High Due to the Competition within the Battery Space

There are always risks with high-growth company’s but especially small-time battery makers. However, analysts and retail alike ignore many of these battery companies in the public eye at around 4.5 dollars and down over half from its SPAC offering price. The risks reward ratio is looking favorable for investors. Shares look good at these levels, and I am inclined to be bullish given all the company’s reactions from a production and technological view. Batteries are a growing field, and it is clear that lithium metal batteries are the best even though solid-state technology is on the horizon for commercially viable batteries born from lithium-metal-based companies.

Investors need to do due diligence to understand the undervaluation of the stock

The valuation methods for this company need to be thrown entirely out the window. It’s not about how much SES AI can earn. It’s all about what the technology says and what implementation the company can have with major automakers moving forward. I compared SES AI to two significant companies I see as competitors. Firstly, I choose QuantumScape purely because I have done the most coverage on that stock and know its ins and outs. The entire sector has been hammered, and so have all the leaders. SES AI is now down below its IPO price and is in a similar situation to the next competitor. Solid Power is a solid-state lithium metal battery company backed by various OEMs. This support has helped push Solid Power onto the main stage. I believe similar phenomena could happen with SES AI if they can commercialize sooner than competitors.

SES AI Seeking Alpha Peer Price Return

Source: (SES AI Seeking Alpha Peer Price Return)

The entire sector has fallen with the rest of the market due to other recent corrections in growth stocks. These stocks are primed for a penalty as some of them were outperforming the S&P for some time while having no actual earnings. This was not a good place for these companies to be in and I am much more bullish now given the price depreciation individually for SES AI.

Conclusion and Rating

I look at batteries as a burgeoning industry with a variety of players. While QuantumScape and Solid Power will continue to lead, there is still space for SES AI. The company is diversified across multiple businesses that could end up supporting both competitors mentioned above. I rate SES AI a buy based on the commercialization outlook, but I am still hesitant to go all-in because of the current macro environment’s risk picture.