imaginima/E+ via Getty Images

REIT Rankings: Industrial

Hoya Capital

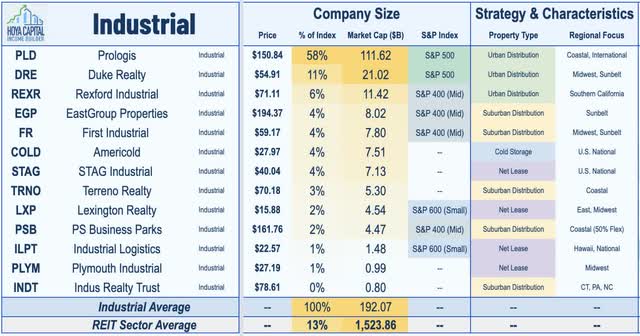

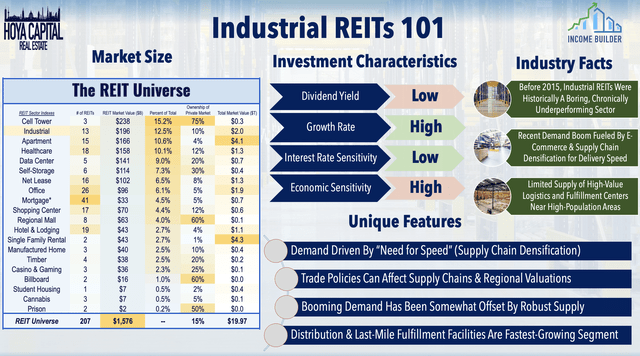

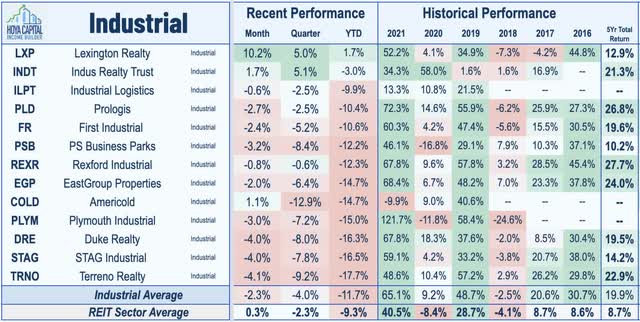

On the front-lines of the historic supply-chain shortages, Industrial REITs outperformed the broad-based REIT Index for the sixth consecutive year in 2021, but have uncharacteristically lagged in early 2022. Led by sector stalwart Prologis (PLD), industrial REITs – which have consistently delivered dividend and FFO growth near the top of the REIT sector over the past decade – continue to thrive amid “extreme competition” for logistics and distribution space. In the Hoya Capital Industrial REIT Index, we track the thirteen industrial REITs which account for nearly $200 billion in market value.

Hoya Capital

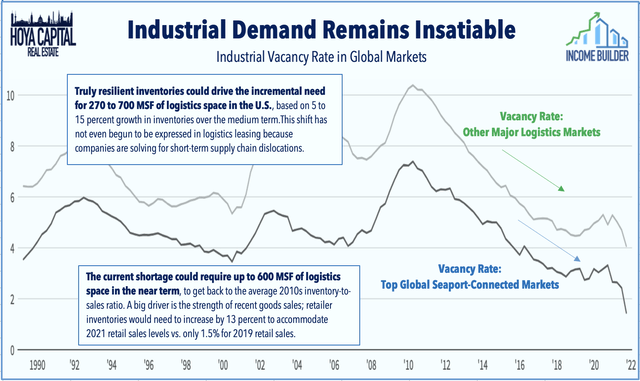

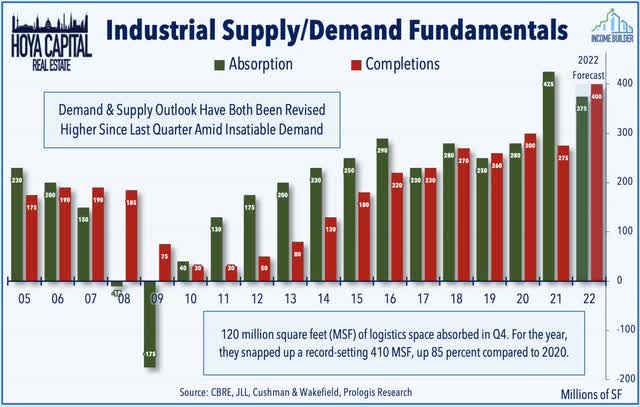

Riding the e-commerce revolution – a wave that has been given an added accelerant by the significant pandemic-related disruptions, industrial REITs have delivered relentless outperformance over the past half-decade, riding similar compelling structural tailwinds of low supply and robust demand as the red-hot U.S. housing industry. The insatiable demand for logistics space has been driven by dueling trends of the “need for speed” in both business-to-consumer and business-to-business goods delivery and, more recently, by the critical need for enhanced supply chain resiliency. Brokerage firms CBRE and JLL each separately reported that industrial occupancy rates declined to record-lows below 4% in Q4 2021 despite robust levels of new development.

Hoya Capital

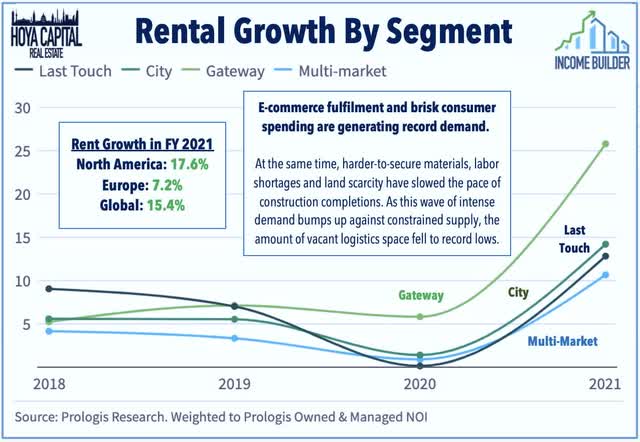

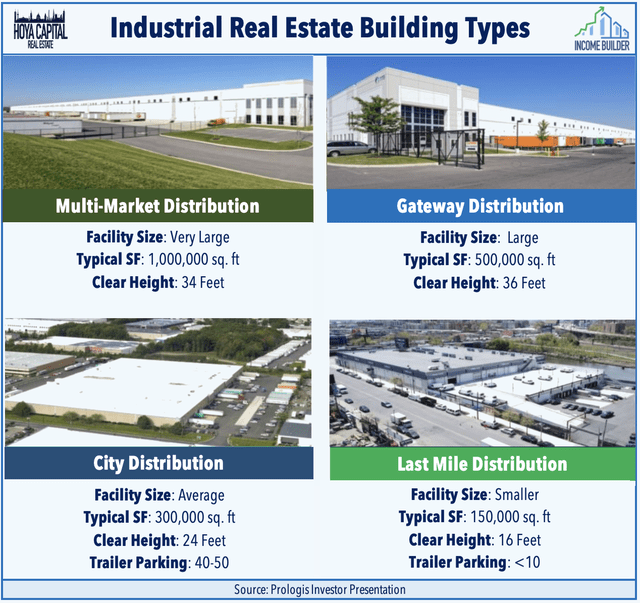

Prologis Research noted that “space is effectively sold out” and with record-low occupancy rates, rent growth soared by historic rates over the last year. Prologis recorded effective annual rent growth of 17.6% in 2021 in North America and 15.4% globally, each the highest rates on record, and sees rent growth in the “high single digits” once again in 2022. “Gateway” locations – large multi-market buildings that incorporate access to major sea and intermodal ports, many of which were “backed-up” due to trucking and labor shortages – recorded the fastest rent growth with several major markets seeing annual rent growth in excess of 50%.

Hoya Capital

CBRE (CBRE) reported last month that the industrial market achieved these record-high asking rents due to “extremely tight space conditions” as demand well-outpaced supply, made worse by the construction delays due to harder-to-secure materials, labor shortages, and land scarcity. With the limited amount of permitted land soaring 50% in value according to Prologis, completions pulled back in 2021 to 275M sq. ft – down 10% from the prior year. Meanwhile, net absorption totaled 121.9M SF in Q4, bringing the full-year total to 432.5M SF -up 81.4% from 2020 and the highest annual volume on record. CBRE pointed out that the need to keep more “safety stock” onshore has spurred additional demand for warehouse space and saw demand not just from the major logistics firms, but from a “diverse array of industries.”

Hoya Capital

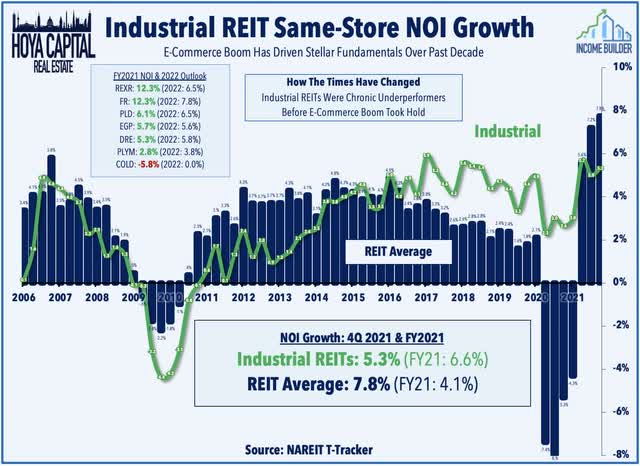

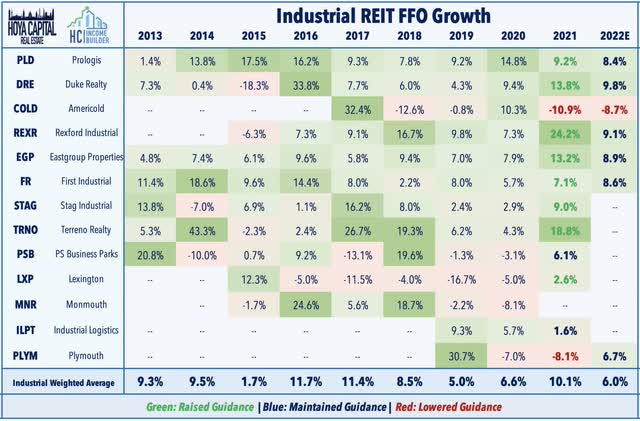

Consistent with these trends, as discussed in our REIT Earnings Recap, industrial REITs delivered another impressive quarter in Q4 as supply chain woes did little to slow down the red-hot industrial REIT sector. Six of the seven REITs that provide full-year NOI and FFO guidance reported final 2021 results that exceeded their most recent (upwardly reviewed) outlook, indicating that fundamentals remain stellar across the sector as insatiable demand clashes with limited supply. Upside standouts included First Industrial (FR), which recorded NOI growth of 12.3% in 2021 and expects further growth of 7.8% this year – both of which were the highest in the industrial sector. One notable exception was Americold (COLD) – the lone cold storage operator – which delivered a weak report, recording an FFO decline of nearly 11% in 2021.

Hoya Capital

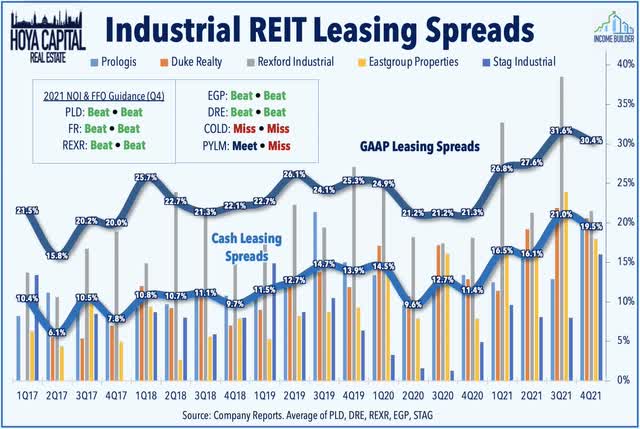

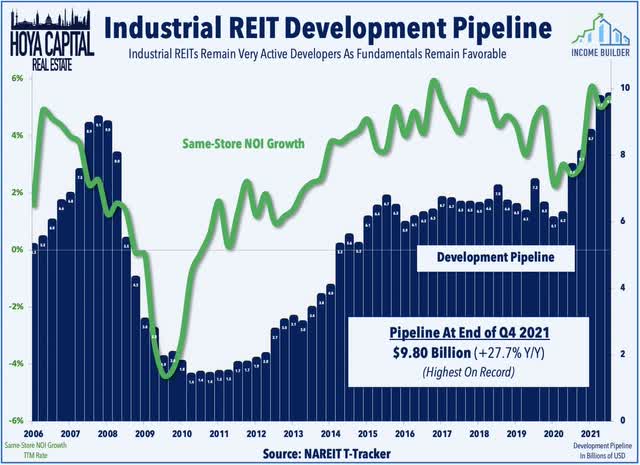

Industrial development has increased significantly over the past five years, but it hasn’t been nearly enough to relieve upward pressure on rents, which have more than doubled since 2015 in the United States as industrial REITs reported record-high leasing spreads in Q3 and Q4 with GAAP spreads increasing over 30% for the first time ever and cash leasing spreads rising roughly 20% in the back-half of 2021. These double-digit rent spreads are expected to results in another year of mid-single-digit same-store NOI growth with First Industrial – which owns a more “suburban-oriented” portfolio than its peers – seeing the strongest rate of NOI growth at 7.8% for 2022 followed by Prologis and Rexford (REXR) at 6.5%.

Hoya Capital

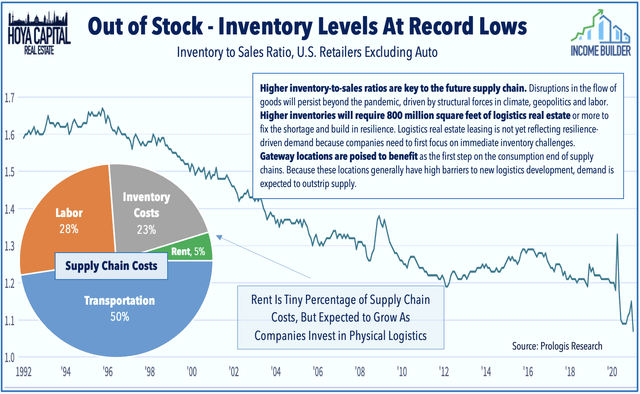

Deeper Dive Into The Industrial Sector

From the inability to find toilet paper and PPE to the blockage of the Suez Canal and surging commodities prices, the coronavirus pandemic and subsequent geopolitical tensions amid the Russia/Ukraine conflict have exposed the extreme fragility of global supply chains across essentially all goods-producing segments of the economy. Supply chain disruptions came as inventory levels were already historically lean amid a shift towards “just-in-time” inventory management. Resilient supply chains will require substantial investments in the logistics space with Prologis pegging the number at 800 million extra square feet just to reach equilibrium.

Hoya Capital

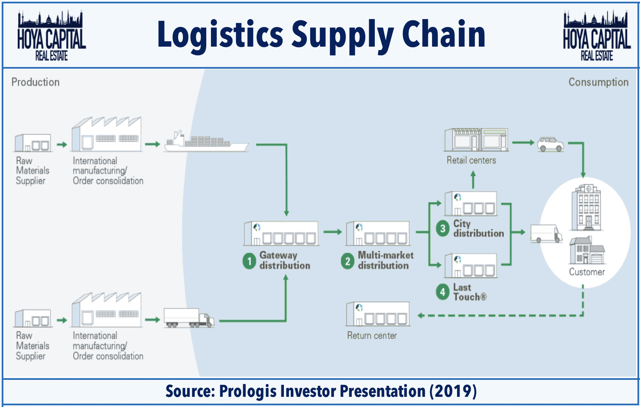

Industrial REITs own roughly 5-10% of total industrial real estate assets in the United States but own a higher relative percentage of higher-value distribution-focused assets with building sizes averaging around 200,000 square feet, which have seen significant rent growth and more favorable supply/demand conditions due to tangible constraints on land availability. Robust demand for space over the past decade has been driven by a relentless “need for speed” arms race as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks.

Hoya Capital

Prologis segments industrial real estate assets into four major segments: Multi-Market Distribution, Gateway Distribution, City Distribution, and Last-Touch Centers. Along that continuum towards the end-consumer, the relative value of these properties (on a per square foot basis) increases, as do the underlying barriers to entry due to scarcity of permittable land. Rent growth has been most robust over the last half-decade in the segments closer to the end-consumer – typically occupied by distributors like UPS (UPS), and FedEx (FDX) – a trend that has been further accelerated by the pandemic.

Hoya Capital

These “just-in-case” trends are additive to the pre-existing “need for speed” trends which continue to be driven most prominently by e-commerce giant Amazon (AMZN) and increasingly by Walmart (WMT), Target (TGT), Home Depot (HD), and Lowe’s (LOW). The pandemic significantly accelerated the penetration rate of e-commerce, which requires up to three times more logistics space than sales through traditional brick and mortar sales. A potential double-edged sword for industrial REITs, the shortage of industrial space itself has driven investments into logistics technologies that could eventually lead to higher levels of space efficiency, higher utilization rates, and eventually could marginally reduce the need for physical space.

Hoya Capital

Industrial REIT Stock Price Performance

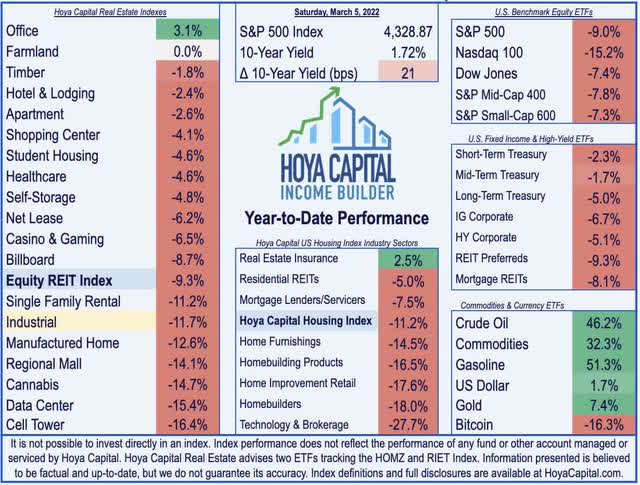

Despite the strong earnings season and stellar fundamentals, industrial REITs have uncharacteristically underperformed in early 2022 amid a broader rotation from growth to value, which has also dragged on the performance of technology and faster-growing residential REITs. Heading into the first full week of March, industrial REITs are lower by roughly 12% so far on the year, trailing the 9.3% decline from the broad-based Vanguard Real Estate ETF (VNQ) and the 9.0% decline from the S&P 500 ETF (SPY).

Hoya Capital

These declines, however, come after recording a remarkable sixth straight year of outperformance in 2021, a streak that trails only the manufactured housing sector, which has delivered nine-straight years of outperformance. Twelve of the thirteen industrial REITs delivered positive total returns in 2021 led to the upside by Plymouth Industrial (PLYM) which made significant strides in improving its corporate governance, while also benefiting from inclusion in the MSCI REIT Index, and from the broader theme of outperformance from REITs focused on secondary and tertiary markets. Lexington Realty (LXP) is the lone industrial REIT in positive territory, while other smaller-cap names have also delivered notable outperformance including INDUS Realty (INDT) and Industrial Logistics (ILPT)

Hoya Capital

Industrial REIT Earnings Analysis

Industrial REITs continue to see significant value-add opportunities in ground-up development with development yields averaging 6-8% compared to cap rates between 4% and 6%. While industrial supply growth is averaging roughly 2-3% per year, this is still shy of the mid-single-digit supply growth rates seen in the self-storage and data center sectors in response to a period of strong rental growth. Trends over the past three years lead us to believe that there are mounting barriers to entry and supply constraints, but industrial REITs have built up a sizable land bank over the last decade and are now responsible for a significant percentage of total industrial real estate development.

Hoya Capital

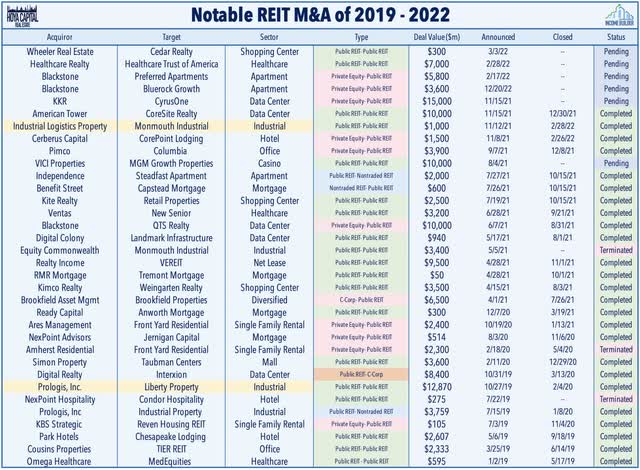

In addition to development-fueled, industrial REITs continue to benefit from the added tailwind of external growth through acquisitions which picked up again in 2021 as the “animal spirits” have come alive across the REIT sector. After years of relying on ground-up development to fuel external growth, industrial REITs have been a bit more active on the acquisition side, acquiring nearly $4B in net assets in 2021. Prologis has been far-and-away the most active acquirer over the past half-decade with major acquisitions of DCT Industrial in 2018 for roughly $8B, Industrial Property Trust in 2019 of $4B, and Liberty Property Trust in 2020 for $13B.

Hoya Capital

Industrial REITs have been fairly quiet on the large-scale M&A front compared with other property sectors, but there was one notable acquisition last year as Industrial Logistics acquired Monmouth Real Estate in an all-cash deal that closed last month in a move that will give ILPT enhanced scale and geographic diversification into the mainland U.S. outside of their primarily Hawaii market. The deal came after prior offers from Equity Commonwealth (EQC) at $18/share and Starwood Capital at $19.40/share. ILPT is financing the deal through a combination of portfolio sales and through the formation of a joint venture with several institutional investors.

Hoya Capital

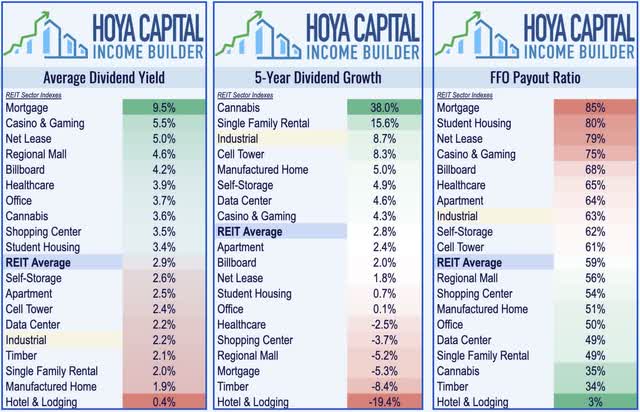

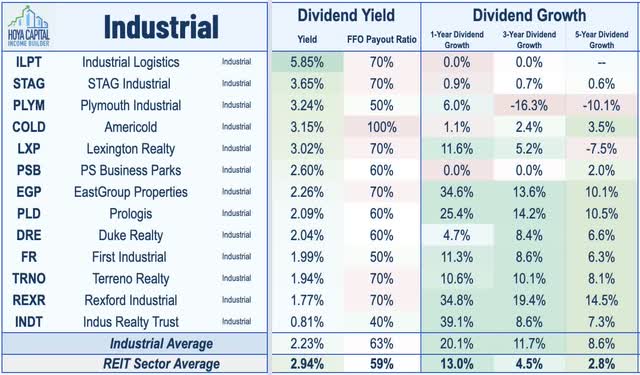

Industrial REIT Dividend Yields

Appreciated more for their dividend growth than their current yields, industrial REITs pay an average dividend yield of 2.2%, which is below the REIT average of roughly 2.9%. However, it’s important to note that Industrial REITs have grown both dividend distributions and FFO by nearly 10% per year since 2014, significantly higher than the REIT sector average of roughly 5%. Industrial REITs pay out roughly 60% of their available free cash flow, leaving an ample cushion for development-fueled growth and future dividend increases.

Hoya Capital

Within the sector, we note the varying strategies of the thirteen industrial REITs where the “tradeoff” between high current yield and long-term dividend growth becomes quite apparent. The five “Yield REITs” at the top of the chart pay an average current yield between 3.0%-5.8% but have seen their dividends grow at slower rates. On the other hand, the remaining eight “Growth REITs” pay an average dividend yield of around 1.8% but have seen their dividends grow by an average of 10% per year over the past five years.

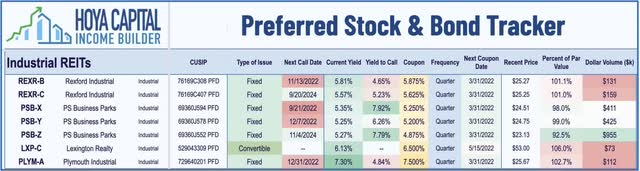

Hoya Capital

For investors looking to take the “preferred route,” four of the thirteen REITs offer preferred securities including two issues from Rexford (REXR.PB, REXR.PC), a suite of three issues from PS Business Parks (PSB.PX, PSB.PY, PSB.PZ), one convertible issue from Lexington (LXP.PC), and one from Plymouth (PLYM.PA). These 7 securities pay an average yield of 5.82% – a notable premium to the average common stock dividend yield – and trade roughly at par value, on average. Last month, as part of its acquisition by ILPT, Monmouth’s Series C Preferred was redeemed at par value.

Hoya Capital

Takeaways: Supply Chains Stretched To Breaking Point

The coronavirus pandemic and subsequent geopolitical tensions have exposed the extreme fragility of global supply chains and the need for enhanced resiliency at all levels of the distribution network. The shift from “just-in-time” to “just-in-case” supply chains is expected to create more than 100 million square feet of additional logistics demand per year over the next five years without accounting for a rise in sales. Sharing similar supply/demand dynamics as the U.S. housing sector, industrial REITs continue to enjoy some of the strongest property-level fundamentals across the real estate sector. Stellar fundamentals rarely come cheap and industrial REITs continually screen as some of the more expensive REITs, but we expect that investors that are willing to “pay up” for quality will be rewarded.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital