DUBLIN–(BUSINESS WIRE)–The “North America Life Science Tools Market Size, Share & Trends Analysis Report by End-use, by Technology (Cell Biology, Proteomics Technologies), by Product (PCR & qPCR, Cell Biology), and Segment Forecasts, 2020-2027” report has been added to ResearchAndMarkets.com’s offering.

The North America life science tools market size is expected to reach USD 81.9 billion by 2027 registering a CAGR of 11.6%

The market growth is attributed to a rise in government funding for life science technologies, growth of cell & gene therapies, increasing demand for biopharmaceuticals, and a rise in competition among prominent market entities.

Competitive dynamics continue to drive a rapid pace of innovation in sequencing, multiplex platforms, and major categories of mass spectrometry and liquid chromatography; this supports growth via upgrade/replacement cycles and expands the applicability of technologies. An increase in investments for R&D of life science tools is expected to drive the market significantly.

For instance, Thermofisher Scientific, one of the leading players in the market, increased its R&D expenditure by 7.32% to USD 0.264 billion year-over-year by the quarter ending June 30, 2020. A rise in the number of strategic deals & developments coupled with the steady commercial success of biopharmaceuticals is expected to accelerate market growth over the forecast period.

The Bristol-Myers Squibb/Celgene acquisition (USD 74 billion), AbbVie/Allergan acquisition (USD 63 billion), Takeda/Shire acquisition (USD 58.6 billion), Danaher and GE Biopharma M&A deal (USD 21.4 billion), Amgen/Celgene’s Otezla deal (USD 13.4 billion), and Pfizer/Array Biopharma merger (USD 11.4 billion) were some of the largest biopharma merger and acquisition deals of 2019.

Key Topics Covered:

Chapter 1 Methodology and Scope

1.1 Research Assumptions

1.2 Research Methodology

1.3 Information Procurement

1.4 Information or Data Analysis

1.5 Market Formulation & Validation

1.6 Market Model

1.6.1 Nucleic Acid Preparation market

1.6.2 Cell biology market

1.6.2.1 Comparison of 3D cell culture techniques

1.6.3 Next-Generation Sequencing & Transfection Electroporation market

1.6.4 Market study, by Technology

1.6.5 QFD modeling for market share assessment of technologies

1.6.6 Market study, by end use

1.7 Global Market: CAGR Calculation

1.8 Objectives

Chapter 2 Executive Summary

2.1 Market Summary, 2019

Chapter 3 Market Variables, Trends, & Scope

3.1 Market Dynamics

3.1.1 Market driver analysis

3.1.1.1 Increased government funding for life science technologies

3.1.1.2 Growth of cell and gene therapies

3.1.1.3 Rise in demand for biopharmaceuticals (biologics and biosimilars)

3.1.1.4 Technological advancements in life science tools

3.1.1.5 Applications of genomic and proteomic technologies for precision medicine

3.1.2 Market restraint analysis

3.1.2.1 High cost for some technologies

3.1.2.2 Dearth of skilled professionals

3.1.3 Market opportunity analysis

3.1.3.1 Rise in the number of strategic deals & developments

3.2 Penetration and Growth Prospect Mapping for Technology, 2019 (USD Million)

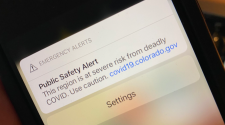

3.3 Impact of COVID-19 pandemic on North America Life Science Tools Market

3.3.1 Impact on the supply chain

3.3.2 Impact on life sciences & healthcare industry

3.4 Market Share Analysis

3.4.1 Company Size

3.4.2 Product portfolio

3.4.3 Strategic Initiatives

3.5 Business Environment Analysis

3.5.1 SWOT Analysis; By factor (Political & Legal, Economic, and Technological)

3.5.2 Porter’s Five Forces Analysis

Chapter 4 Technology Movement Analysis

4.1 Market: Technology Movement Analysis

4.2 Genomic Technology

4.3 Proteomics Technology

4.4 Cell Biology Technology

4.5 Other Analytical & Sample Preparation Technology

4.6 Lab Supplies & Technologies

Chapter 5 Product Business Analysis

5.1 North America Life Science Tools Market: Product Movement Analysis

5.2 Next-Generation Sequencing

5.2.1 Market estimates and forecast for NGS, 2016-2027 (USD Million)

5.2.2 Instruments

5.2.3 Consumables

5.2.4 Services

5.3 PCR & qPCR

5.4 Flow Cytometry

5.5 Nuclear Magnetic Resonance Spectroscopy (NMR)

5.6 Microscopy & Electron Microscopy

5.7 Liquid Chromatography (LC)

5.8 Mass Spectrometry (MS)

5.9 Nucleic Acid Preparation (NAP)

5.10 Transfection Electroporation

5.11 Cell Biology

5.12 Cloning

5.13 Other products & services

5.13.1 Market for other products & services, 2016-2027 (USD Million)

5.13.2 Antibodies

5.13.3 General supplies

5.13.4 Nucleic Acid Microarray

5.13.4.1 Instruments

5.13.4.2 Consumables

5.13.4.3 Services

5.13.5 Others

5.13.5.1 Market for others, 2016-2027 (USD Million)

5.13.5.2 Instruments

5.13.5.3 Consumables

5.13.5.4 Services

Chapter 6 End-use Movement Analysis

6.1 Market: End-use Movement Analysis

6.2 Government & Academic

6.3 Biopharmaceutical Company

6.4 Healthcare

6.5 Industrial Application

Chapter 7 Regional Movement Analysis

Chapter 8 Company Profiles

- Thermo Fisher Scientific, Inc.

- F. Hoffmann – La Roche Ltd.

- Illumina, Inc.

- Agilent Technologies

- Becton, Dickinson and Company (BD)

- Bio – Rad Laboratories, Inc.

- Danaher Corporation

- General Electric Company

- Merck KGaA

- QIAGEN

- Corning Incorporated

- Perkin Elmer, Inc.

- Miltenyi Biotec

- Bruker

- Hitachi Koki Co., Ltd.

- Shimadzu Corporation

- Oxford Instruments

For more information about this report visit https://www.researchandmarkets.com/r/v3vaqg