Stock markets in New York and Toronto sold off on Thursday, led by shares in technology companies that have been on a tear since the coronavirus pandemic began.

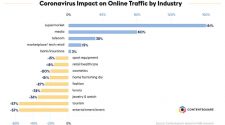

The technology-focused Nasdaq closed down 598.36 points, or almost five per cent, to hit 11,458 on Thursday. The Nasdaq has been on a tear for months as investors pour money into technology companies like Netflix, Amazon, Zoom and Google, because of booming demand for their services due to millions of people spending more and more time online because of COVID-19 lockdowns.

“The leading sector for quite a long time has been the Nasdaq, which is very heavily weighted in technology stocks, so people just saw this as an opportunity to take the profits off the table,” said Randy Frederick, vice-president of trading and derivatives for Charles Schwab in Austin, Texas.

“Some of the stocks have gotten a little pricey, and what the actual cause is to spark this sell-off is difficult to say.”

FAANG stocks fading

Thursday is shaping up to be the worst day for the Nasdaq since June. It’s also the worst day for the so-called FAANG stocks — Facebook, Amazon, Apple, Netflix and Google — since March.

Companies like Netflix have seen their stocks soar in the pandemic because people cooped up at home have driven demand for their services. Netflix was worth less than $300 a share in March but currently trades at more than $500. But new downloads of the app were lower in July and August than they were a year ago, Bloomberg Intelligence analyst Geetha Ranganathan noted in a report on Thursday.

“After four months of explosive gains, Netflix’s quarter-to-date global downloads have cooled, suggesting that the service may be returning to normalized subscriber growth,” she said.

Larry Berman, portfolio manager and chief investment officer at ETF Capital Management, said the tech sell-off is to be expected, given how detached some of the tech stocks have been from the realities of the actual economy of late.

“It was more speculative than it was real,” he said in an interview. “It’s probably a realization that the economic numbers that we are seeing aren’t bouncing back as strong.”

Semiconductor stocks also fell sharply. Nvidia, Qorvo and Advanced Micro Devices fell 8 per cent or more. Even with Thursday’s drop Nvidia is still the biggest gainer in the S&P 500 so far this year, up almost six-fold in the past 12 months.

Not just tech

But technology stocks weren’t the only ones selling off. The Dow Jones Industrial Average group of 30 big companies lost 800 points or almost three per cent, and the broader S&P 500 was off by even more, 3.5 per cent. Losses were slightly lower in Toronto, where the benchmark S&P/TSX Composite Index lost 249 point or almost 1.5 per cent.

Shopify, which became the most valuable company in Canada in this pandemic, lost about five per cent of its value to close at just over $1,332 a share. Shopify’s TSX listed shares tripled between the start of April and Wednesday.

Shares in TSX-listed payment processing firm Lightspeed also lost about eight per cent to close at $43.70 a share. Since bottoming out at $12 a share in March, shares in Lightspeed had almost quadrupled prior to this week’s swoon.