Viriyah Insurance showcases new technology for the digital disruption era, proving itself as Thailand’s number one non-life insurance company, on top of stellar performance in 2019 with total premiums of 38 billion baht, a growth of 2.57%

Viriyah Insurance announced its recent technological achievement, emphasising its reputation as Thailand’s number one non-life insurance company in the “Digital Disruption” era, by launching successful technological innovations in three main areas: data analysis, partner connectivity, and claims services. In addition, it has moved one step further by introducing a new mobile claims service platform called “VClaim on Vcall.”

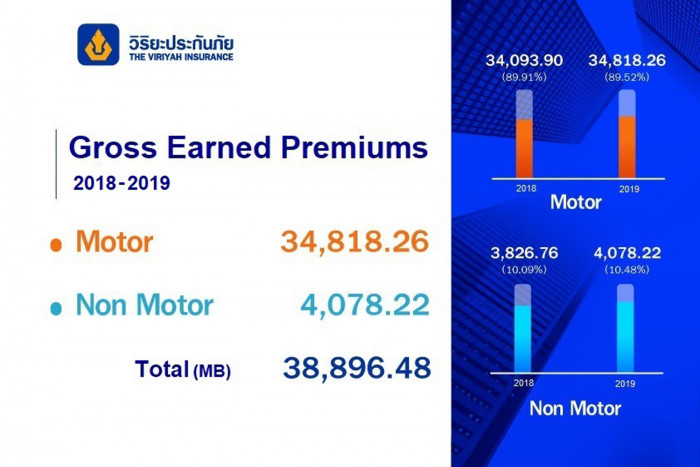

“We believe that technological success will make our 2020 business turnover grow by 3%. As for 2019, we earned a total premium of 38.896 billion baht,” disclosed Mr. Amorn Thongthew, Director and Assistant Managing Director of The Viriyah Insurance Public Company Limited.

“Our revenue from the insurance premiums, excluding motor insurance, amounted to 4.078 billion baht, with health insurance and carrier’s liability insurance as the products that are growing at a striking rate.”

“Business operations in 2020 have continued to be challenging, making the overall economic situation look unpromising. Factors include the impact of the global and domestic economy, the Thai baht’s value, the exporting trend, and the latest crisis from the new coronavirus, COVID-19. Additionally, business operators have to struggle with the internal factors of adapting to the digital disruption era.”

“Digital technology has increasingly played an important role in the insurance business as it can be implemented to make a difference and meet the needs of consumers. It also helps deliver solutions to several pain points in the insurance industry, including products and services.”

Mr. Amorn Thongthew, Director and Assistant Managing Director

Mr. Amorn further stated that, “As Thailand’s number one non-life insurer, Viriyah Insurance is determined to handle customers’ risks in a professional manner, i.e., quickly, accurately, and fairly. More importantly, the company has continued to gain trust from customers more and more each year. Currently, it holds 16% market share in the non-life insurance industry, or equivalent to a ratio of 1:6. In other words, out of six insured people, one is Viriyah’s customer.”

As of today, Viriyah Insurance is serving customers with approximately 8 million policies on hand, consisting of 6.5 million motor insurance policies and 1.5 million non-motor insurance policies. Based on those policies, it has processed over 1 million insurance claims per year. The claims service is considered a significant and challenging mission that needs utmost attention to ensure satisfactory services for the insured.

As mentioned above, the digital era forces all the insurance providers to be prepared for any disruption. Consumer behaviours become more complex with different lifestyles and increasing new technological platforms.

In response to these changes, the company realises the urgent need for technology which has been incorporated into the business practices, focusing on innovations in the three main areas as follows:

1. Data-Driven Technology – This is an analytical tool that helps gain customer insights, such as CRM system. During the past few years, the company has kept up with the technology. This year the company continues utilising efficient technology to make use of existing large amounts of data in every process of work, especially claims services. Data analytics is crucial to help the company analyse the historical data and accurately predict future occurrences. As a result, we can develop our products and services to meet the needs of our customers promptly and appropriately. We would like our customers to realise the benefits of having insurance to help solve any problems or ease the burden of unexpected expenses for them and their families.

2. Application Programming Interface – The new technology platform has helped the Viriyah Insurance brand get more connection and access to its target group through business alliances or partnerships quickly and conveniently with a reduced operation cost. Last year, the company partnered with many alliances to expand its distribution channel and develop new products and services for each customer group that has different needs and lifestyles. Eventually, both the customers and the business entity will gain mutual benefits from the insurance.

3. Technology for Claims Services – Viriyah Insurance has always focused on developing innovations for claims services. According to motor insurance claims statistics, it was found that most claims are those without the other party. In that case, the customers can file a claim at a later time. The company selects the right technology to accommodate its customers so that they do not have to travel to the company and wait for the claims adjuster. Instead, they can just file a claim via “VClaim on VCall.” It is a real-time video call system that is easy to use and convenient, a perfect alternative for tech-savvy customers.

Regarding non-motor insurance, Mr. Amorn added that, “As a trusted brand, the company gains confidence and can approach customers with ease, due to its reputation in terms of claims services for over 73 years. The company has acquired experience and expertise in motor insurance for a long time. Consequently, its expansion into the non-motor insurance market has been quite successful considering the increasing growth rate. The company aims to increase the non-motor insurance sector by 20% in 5 years.”

As for business turnover in 2019, Mr. Amorn stated that, “Overall economic factors last year were negative in every aspect, causing steady decreases in GDP estimates. Nevertheless, the company’s annual report indicated positive growth, with total premiums of 38.896 billion baht, including motor insurance premium of 34.818 billion baht (89.52%) and non-motor insurance premium of 4.078 billion baht (10.48%). We still maintained a good loss ratio of 63.33%. In terms of the company’s stability, our asset value is 72.077 billion baht, a total capital require ratio of 215.90%, which is more than the standard set by the OIC at 150%.”

“With the greatest success yet, it was decided that the company’s corporate image promotion campaign for 2020 is ‘Thanks for making us No. 1.’ We would like to thank our customers, agents, brokers, partners, and alliances in every sector for their trust in our company as an insurance provider. We can’t become No. 1 in the non-life insurance industry without their continuing support for 33 years.”

**OIC: Office of Insurance Commission under the supervision of the Thai Ministry of Finance