Google’s first quarter earnings were an early warning flare, highlighting how tech companies that rely heavily on digital advertising are exposed to the broader economic head winds caused by the novel coronavirus. But the company indicated other areas of its business are benefiting as people’s work and entertainment shift online.

“Most people had assumed advertising revenue was getting weaker,” Mark Mahaney, a managing director covering Internet research at RBC Capital Markets, told me. “They got confirmation of that.”

Chief executive Sundar Pichai reported a strong performance in January and February, punctuated by what called a “abrupt decline” in advertising spending in March. Key customers in the travel sector made major cuts to advertising spending.

The company reported revenue in the first quarter was up 13 percent despite the drop-off, my colleague Rachel Lerman reports. Yet people are using Google’s services more than ever, and the virus is accelerating a digital shift causing more companies to consider cloud-computing products.

Google CEO Sundar Pichai speaks during the keynote address of the Google I/O conference in Mountain View, Calif., Tuesday, May 7, 2019. (AP Photo/Jeff Chiu)

The Google executives described the results as a “tale of two quarters.”

The call could also be a tale of two fortunes for the entire tech giants, which is releasing its earnings from the first three months of the year this week.

Tech companies such as Facebook and Twitter that rely primarily on digital advertising are vulnerable to the broad economic upheaval caused by the coronavirus. Meanwhile, other tech giants including Microsoft and Amazon providing cloud services, grocery deliveries or videoconferencing tools stand to benefit amid widespread stay-at-home and telework orders.

Facebook reports its earnings today, and Twitter’s call is tomorrow.

Twitter already pulled its first quarter guidance, warning investors in March the coronavirus had slowed advertising. Twitter’s Chief Financial Officer Ned Segal said the coronavirus had impacted Twitter’s advertising revenue globally “more significantly” in March as it spread to pandemic levels.

Mahaney said Facebook’s ad revenue will likely track with Google’s.

“Facebook is going to report somewhat similar results,” Mahaney said. However, he noted Facebook would be less exposed to a decline in travel ad spending because those type of ads more commonly accompany searches.

With so much uncertainty about the virus, it’s unclear when companies will see digital advertising turn around.

Ruth Porat, Alphabet’s chief financial officer, said the company saw ad revenue begin to decline in March — ending the month with a mid-teen decline in such spending year-over-year. Users’ search activity increased but shifted to less-commercial topics.

“To gauge the ongoing potential financial impact to our business from covid-19, a key signal to monitor is macroeconomic performance, which has tended to be correlated with advertising spend,” she said. “As of today, we anticipate that the second quarter will be a difficult one for our advertising business.”

Despite the warning, the company’s stock was soaring 9 percent in after-hours trading on Tuesday. That left some analysts shocked.

“I’m blown away that the market thinks this is good,” said Michael Pachter, an analyst at Wedbush Securities.

Meanwhile, the earnings call may be good news for Microsoft and Amazon, which have large cloud computing businesses.

Analysts say that the two Washington state giants can expect steady enterprise business as more workers log on from home, and Microsoft is likely to see strong results in its video game business.

Microsoft reports today, and Amazon’s call is tomorrow.

Our top tabs

Most Americans are unwilling or unable to use an app to track coronavirus infections.

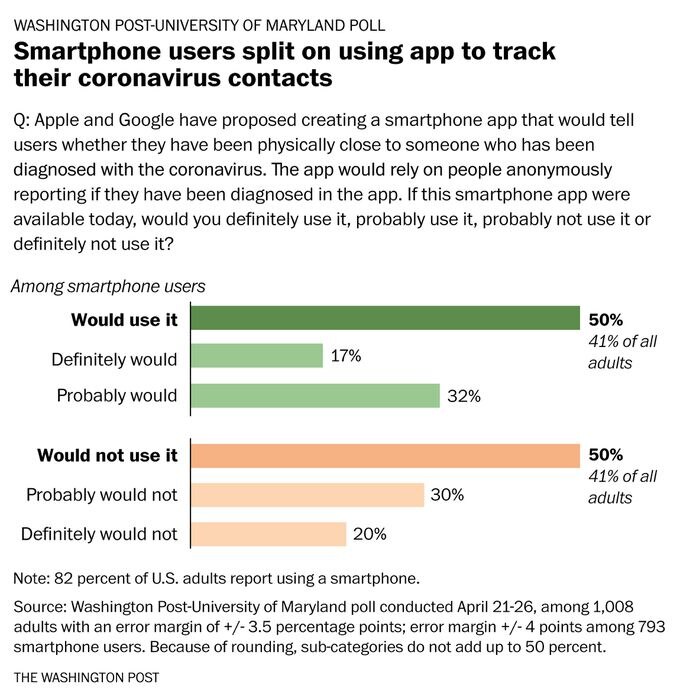

That’s the response from nearly 3 in 5 Americans in a new Washington Post-University of Maryland poll. The findings suggest it could be difficult for Google and Apple’s contact-tracing initiative to attract enough participants to be effective in the fight against the coronavirus, Craig Timberg, Drew Harwell and Alauna Safarpour report.

The polling indicates one major barrier to the tech companies’ plans might be lack of smartphones. About 1 in 6 Americans still do not have such devices, which are necessary to use Bluetooth capabilities on which the public health apps rely. Smartphone adoption is particularly low among seniors, who are particularly vulnerable to the virus. Just over half of those aged 65 or older report they have a smartphone (53 percent). Rates are even lower for those 75 and older, per the Post-U. Md. poll.

Willingness to use the infection-tracing apps is split among the 82 percent of Americans who do have smartphones. Fifty percent say they definitely or probably would use such an app, and an equal percentage say they probably or definitely would not. Willingness was higher among Democrats and people who feared contracting the virus would make them seriously ill.

A major source of concern is a general distrust of the tech giants.

“I don’t feel like they have a good track record of taking care of people’s privacy and data. And I don’t want to give them more if I don’t trust them,” Brent Weight, 43, a Republican-leaning independent voter who runs a small trucking company in Rigby, Idaho, told my colleagues. “Seems like every other day you’re hearing of a data breach in a big company, and they’re losing credit card information and everything else. For them to just tell us it’s going to be safe and anonymized, I’m not going to take them at face value.”

Uber is weighing major layoffs as the pandemic tanks its ride-hailing business.

A deliveryman for Uber Eats rides a bike past a closed cafe in Paris. (Charles Platiau/Reuters)

Top leaders at the ride-hailing giant are considering laying off up to 20 percent of employees at the company, the Information’s Amir Efrati reports. The cuts could eliminate more than 5,400 of the company’s 27,000 employees.

Separately, Uber Chief Technology Officer Thuan Pham is departing the company, Amir writes. Tham is the longest-serving top executive at the company, after working there for about seven years. He’s resigning as the engineering group weighs cutting 800 of its 3,800 employees.

Uber’s core ride-hailing business is down about 80 percent compared to the same period a year ago as stay-at-home orders around the world have dramatically reduced requests for Uber rides.

The company has made gains in its UberEats food delivery service, but nowhere near enough to make up for the lost rides. UberEats business is up about 70 percent from the same period a year ago, and the company’s spending on bonuses for drivers has declined as such work becomes cheaper. UberEats’s 2,300-person team may be more insulated from the layoffs than other units.

Drivers — who are contractors not employees — are unaffected by this round of layoffs. But many are seeking other forms of work, such as delivery gigs at DoorDash and Instacart, as their earnings from ride-hailing dwindle.

The bill has arrived for hosts who bought or leased real estate while chasing Airbnb profits.

Airbnb’s logo. (Dado Ruvic/Reuters)

Hosts are seeing bookings disappear overnight as the coronavirus grinds travel to a halt around the world. Those cancellations could financially devastate people who took on significant real estate debt with the expectation that they would be raking in rental income from the short-term booking service, the Wall Street Journal’s Tripp Mickle reports.

“I made a bargain with the devil,” said Cheryl Dopp, who said she saw about $10,000 in bookings evaporate overnight in March. She has $22,000 in monthly expenses for a primarily Airbnb portfolio, which includes Jersey City homes and a house in Miami.

Tripp writes she’s part of “an upper crust” of a gig economy that was particularly vulnerable to the global economic slowdown. The hit on the hosts has reverberated to the cleaning services, interior designers and property-maintenance workers who supported these rentals.

“Hosts should’ve always been prepared for this income to go away,” Gina Marotta, a principal at Argentia, which does credit-risk analysis for real estate loans, told Tripp. “Instead, they built an expensive lifestyle feeding off it.”

There are too few Airbnb properties to spark a housing crisis, but the problems could strain lenders, challenge property values and provide ammunition to local governments who have suspected that Airbnb contributed to the housing crisis.

Inside the industry

Facebook is displacing two dozen employees in an overhaul of its security teams.

“The changes, which took place last week, affected Facebook’s detection-engineering and alert-response teams, said three current and former employees, who spoke on the condition of anonymity because they were not authorized to discuss workplace issues. The employees, whose duties included anticipating cyberattacks and preventing hackers from breaching the platform, were in Facebook’s offices in London, Seattle and Menlo Park, Calif.,” write Sheera Frenkel and Mike Isaac in the New York Times.

Bookmark this

Trending

Instagram is today launching a new way for users to fundraise for nonprofits via Instagram Live, amid the coronavirus pandemic. While the company had already offered Donation Stickers for the use in Stories, the new Live Donations feature will allow anyone to create fundraisers while live streaming…

Rant and rave

An ABC reporter video-conferenced into“Good Morning America” to talk about drones. But eagle-eyed viewers noticed an awkward wardrobe malfunction.

Hey put some pants on my guy pic.twitter.com/PpCIBRrjP5

— Adam Graham (@grahamorama) April 28, 2020

Reporter Will Reeve took it in stride and says he’s now accepting fashion advice:

When WFH goes wrong (or, your self-framed live shot goes too wide).

Hope everyone got a much needed laugh 😂 pic.twitter.com/GbyLBhL7Be— Will Reeve (@ReeveWill) April 28, 2020

Apparently this is a popular sartorial choice at ABC:

In the interest of full disclosure….#UpTopDownBelow@GMA pic.twitter.com/Ey0TOg6Knn

— T.J. Holmes (@tjholmes) April 27, 2020

Daybook

- Facebook and Microsoft will announce earnings today.

- Apple, Amazon and Twitter will announce earnings on Thursday.

Before you log off

Most of The Washington Post is on Day 50 of working from home. Here’s how our own Dave Jorgenson is coping:

Today’s second @washingtonpost quarantine TikTok features a love story https://t.co/PYkywvWEvG pic.twitter.com/clAxyjBILP

— Dave Jorgenson (@davejorgenson) April 28, 2020