Bitcoin offshoots bitcoin cash and bitcoin SV underwent so-called halvings last week, with the number of tokens rewarded to those who maintain the networks cut by half.

Bitcoin cash, which broke away from bitcoin in a 2017 schism that was sparked by technical disagreements but grew into a battle for bitcoin’s soul, broke in two again in 2018, creating bitcoin SV—both of which are struggling following their halvings.

Now, with bitcoin fast approaching its own halving event, scheduled for May 12, it’s make or break for the original and most valuable cryptocurrency.

The bitcoin community broke apart in 2017 but a long-running civil war could be coming to an end.

© 2017 Bloomberg Finance LP

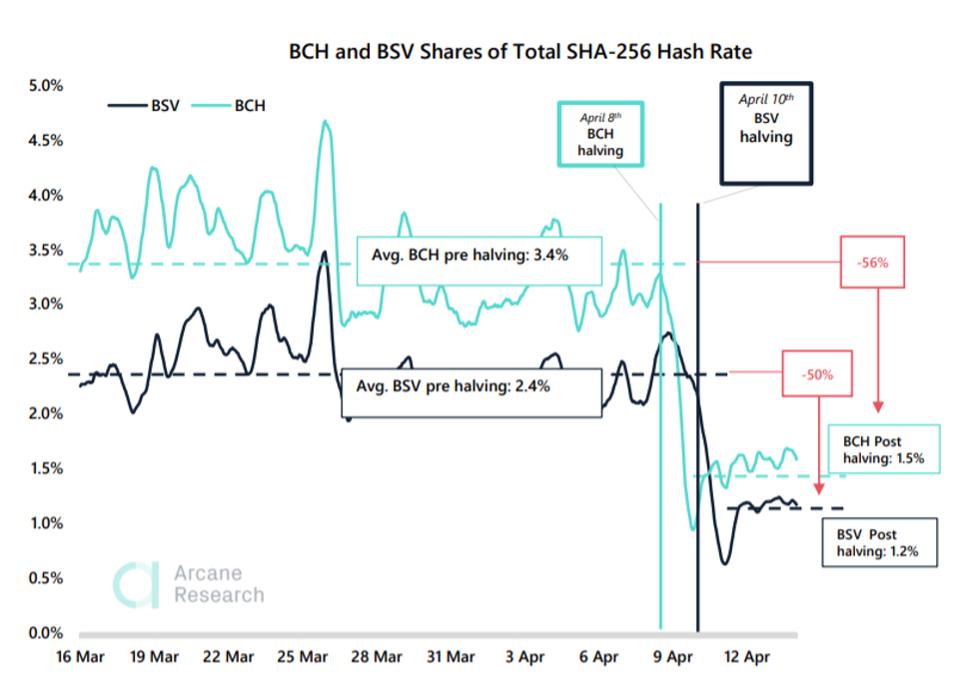

“Going forward it will be interesting to see if someone tries to perform a 51% attack on either bitcoin cash or bitcoin SV, and if so, how the two projects cope,” Arcane Research analyst Vetle Lunde wrote this week, underscoring the existential threat the halvings have created for the two bitcoin forks.

A 51% attack can be carried out on a cryptocurrency if a so-called miner or group of miners control more than half of the network’s computing power, known as its hash rate. A successful 51% attack can destroy confidence in a cryptocurrency, making it effectively worthless.

Next month, the number of bitcoin rewarded to miners that maintain the bitcoin network will be halved for the third time, dropping from 12.5 bitcoin per block to 6.25.

The previous two halvings happened in 2012 and then in 2016. Bitcoin halvings are scheduled to continue roughly once every four years until the maximum supply of 21 million bitcoins has been generated by the network—something that isn’t expected to happen until well into the next century.

Last year, litecoin, often referred to as the crypto silver to bitcoin’s gold, went through its own halving event.

The litecoin price rocketed in the run up the big day but is now down by an eye-watering 70%.

A similar fall for bitcoin would put its price at just over $2,000—forcing many bitcoin miners out of business and leaving the bitcoin network in shambles.

Most don’t expect bitcoin’s upcoming halving to put the same level of stress on the network that’s been seen by bitcoin’s offshoots, nor result in the price falls suffered by litecoin.

“Amidst the rapid reduction in hash rate of the bitcoin forks, bitcoin itself has seen an increase in hash rate,” wrote Lunde, noting bitcoin’s hash rate is approaching a new all-time high.

Both bitcoin cash and bitcoin SV have seen significant falls in their hash rates since their … [+]

Arcane Research

Ahead of the market chaos caused by the coronavirus pandemic, many heavy-hitters in the bitcoin and cryptocurrency community were upbeat about bitcoin’s outlook for the year—with bitcoin’s upcoming halving seen as a potentially positive catalyst for the bitcoin price.

Market and economic turmoil caused by the coronavirus crisis has, however, pushed bitcoin’s halving far down the agenda.

The halving has somewhat captured the attention of bitcoin watchers, with Google searches for “bitcoin halving” spiking over the last week, though halving searches remain dwarfed by bitcoin itself.

While bitcoin’s halving is likely to pass most casual bitcoin users by unnoticed, such extreme, if well-telegraphed, changes to new bitcoin tokens coming onto the market could significantly alter bitcoin’s economic dynamics and the bitcoin and cryptocurrency industry is keen to drum to excitement surrounding the event.

“History tell[s] us that the bitcoin price will typically begin to rise significantly within the 12 months following a halving—something that can be simply put down to supply and demand,” said Danny Scott, the chief executive of U.K.-based bitcoin exchange CoinCorner, adding he expects the bitcoin price to return to its all-time highs of around $20,000 and “beyond.”

“Our data shows an increase in the number of new customers every month since the beginning of 2020. February was up 5% compared to January and March was up 17.6% compared to February. We expect to see this trend continue, not just for the next month, but for the next year.”

The bitcoin price has failed to return to anywhere near its all-time highs in the run up to its … [+]

Coinbase

Others have staked their reputations on bitcoin’s halving and what it could mean for the bitcoin price.

The creator of the closely-followed stock-to-flow bitcoin price model has said bitcoin’s price performance over the next two years will be “make or break” for his predictions.

The stock-to-flow pricing model calculates a ratio based on the existing supply of an asset against how much is entering circulation.

Commodities such as gold–with the largest stock-to-flow ratio of 62, meaning it would take 62 years of gold production to get the current gold stock–have a higher stock-to-flow ratio and are valued by investors for their scarcity.

Bitcoin currently has a stock-to-flow ratio of 25 though the model sees this increasing to 50 after next month’s halving.

“I hope this halving will teach us more about underlying fundamentals and network effects,” the anonymous bitcoin analyst, who is believed to be from the Netherlands, said via Twitter.