Can General Motors finally convince buyers it’s a leader in electric vehicle vehicles and technology? With billions of dollars on the line and high-profile EVs in development for all its brands, the stakes have never been higher.

GM has been the auto industry leader — briefly — in EV technology at least three times since the mid-‘90s, with little to show for it.

“GM has perennially traded leadership in electrification back and forth with Toyota,” Eric Noble of consultant The Carlab said. “They’ve invested billions of dollars for years.”

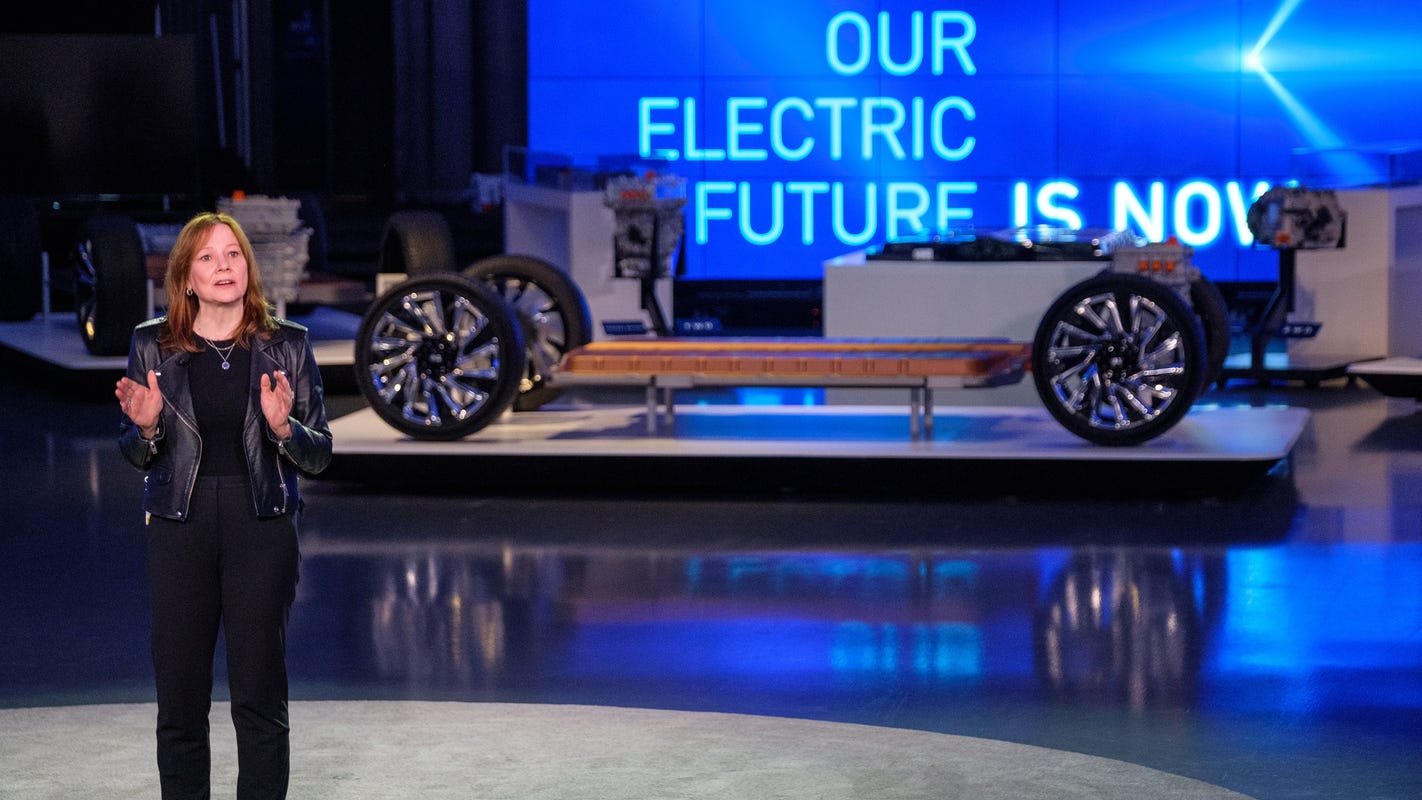

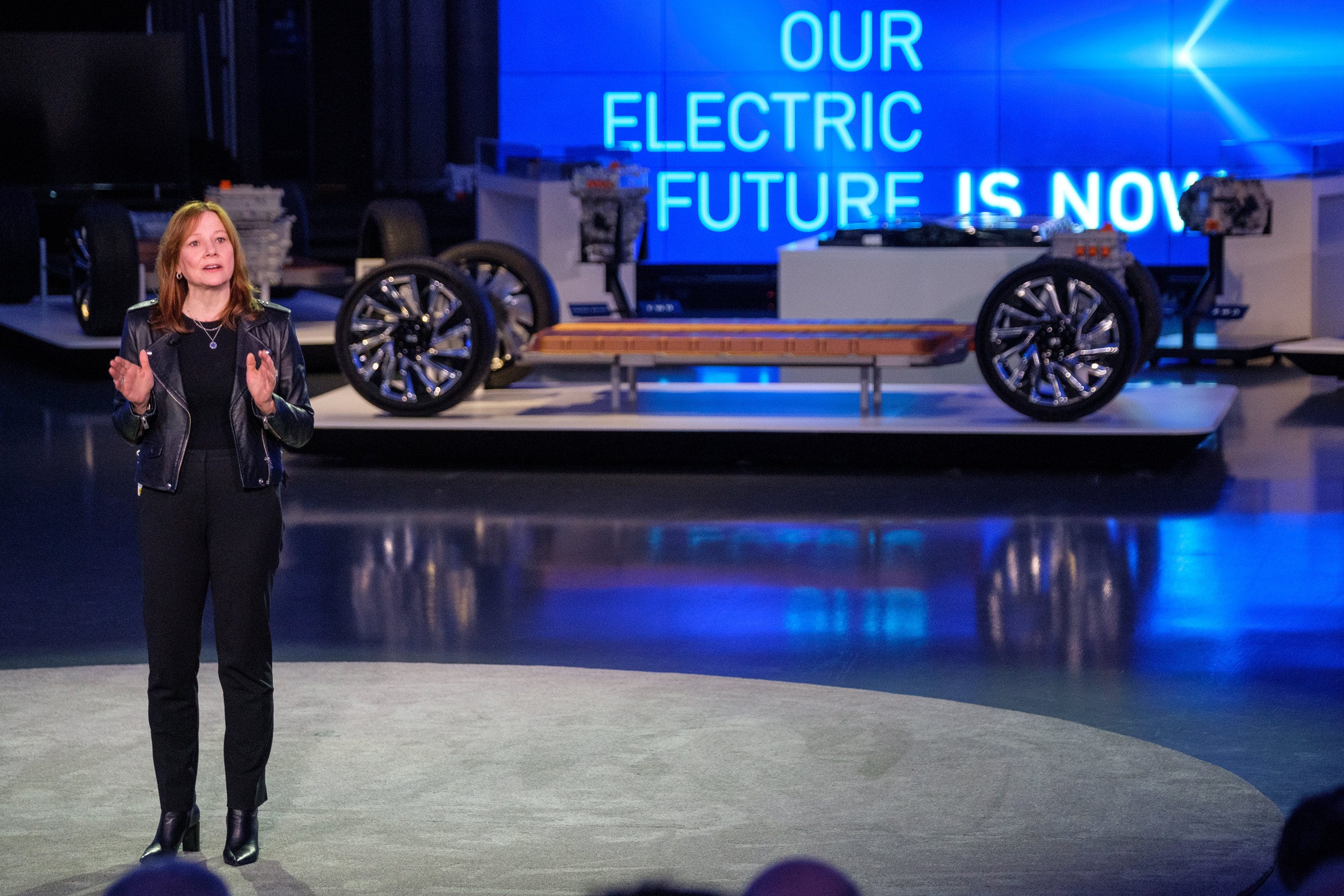

General Motors Chairman and CEO Mary Barra addresses the gathering Wednesday, March 4, 2020 at an event detailing GM’s electric vehicle technologies and upcoming products in the Design Dome on the GM Tech Center campus in Warren, Michigan. (Photo by Steve Fecht for General Motors) (Photo: Steve Fecht,Steve Fecht,Steve Fecht, Steve Fecht for General Motors)

So why is Toyota synonymous with the Prius hybrid, and GM’s Chevrolet and Cadillac brands are most closely associated gasoline-burning pickups and SUVs?

“High profile EVs from Chevrolet — the Volt and Bolt — had little influence on the image of the overall Chevy brand,” in Kelley Blue Book’s Brandwatch analysis, KBB senior analyst Patti Chapman said. “While excellent products, both were relatively low volume and played in small segments of the market.

“Brands are mostly defined by their high-volume” vehicles like the Ford F-150 and Honda Accord. “The Volt and Bolt were simply never big enough sellers to have a positive impact the Chevy brand.”

GM’s electric showroom

So why didn’t GM start with electric pickups and SUVs back in 1996, when it launched the EV1, a little car that could be described as two seats on a cart loaded with batteries?

Because batteries were too heavy and expensive to be feasible in big, heavy vehicles that tow boats and go off-roading.

“Having the best technology is not a guarantee of success if you don’t put it in vehicles the customer wants,” said Sam Abuelsamid, principal analyst for Navigant Research. “GM had great technology, but the market for small cars like the EV1 was limited, the Volt was expensive and the Bolt arrived just as buyers switched from cars to SUVs.”

Third time a charm?

GM’s new generation of EVs, 11 of which the company revealed to journalists and analysts March 4, leans into the strong reputation and high sales enjoyed by GM’s SUVs and pickups.

“Those are markets in which Chevrolet and Cadillac have tremendous credibility,” said IHS Markit senior analyst Stephanie Brinley.

“Battery and motor technology have evolved to make EVs more feasible in those segments.

“We’re looking at the payoff to 25 years of investment and development.”

The peek into GM’s electric showroom includes:

- Cadillac Celestiq: A luxury sedan with a six-figure price tag and made-to-order interiors.

- Cadillac Lyriq: An SUV about the size of the Cadillac XT5 and Audi Q5, due for production in 2022.

- Large Cadillac SUV: About the size of an Escalade, with three rows of seats.

- GMC Hummer SUV and sport utility truck: To be built in the Detroit-Hamtramck assembly plant with three electric motors, 1,000 horsepower and 11,500 pound-feet of torque.

- Two unnamed midsize Buick SUVs

- Chevrolet Full-size pickup: Slated for production in 2025 and certain to spawn a counterpart for the GMC brand.

- Chevrolet midsize SUV: Roughly the size of Chevy Blazer SUV.

GM didn’t allow photos of the vehicles in the briefing at a high-security facility in its Warren, Michigan, tech center

“GM is all-in” said Martin French, managing director of consultant Berylls Strategy Advisors Corp.’s Detroit office.

“The key now is in the execution of the promised product and successful launches that bring the vehicles to market at the right time, cost and quality. We all know that a poorly executed launch can have devastating effects on a company — both financially and on the brand itself.

Yes, it comes in your size

“This isn’t a one-vehicle play, like the Volt and Bolt,” said Ken Morris, GM vice president for autonomous and electric vehicles. “This is a portfolio. We’re trying to include every type of vehicle that people want.”

GM’s earlier EVs were one-offs and adaptations of vehicles developed for conventional engines. That reduced development costs but led to compromises.

“Everything about the new vehicles is built from the ground up to be an EV,” Morris said. “We’re not just putting an electric motor in a pickup.”

Riding on an architecture designed exclusively for EVs, the new vehicles will take full advantage of the benefits to space and handling inherent in putting batteries below the floor and using a mix-and-match approach to battery size and the power, number and location of electric motors.

That approach also simplifies production, reducing cost and the number of things that can go wrong.

“Our commitment is to come up with the best, most cost-effective vehicles we can and improve them every year,” Morris said.

The pieces come together

“This is the first time GM has put all the pieces — technology, vehicle classes and pricing — together,” Abuelsamid said. “The product plan blends EV technology with vehicles in market segments people want.”

One of the keys was developing batteries and electric motors that can be combined in a wide variety of vehicles built in large numbers.

“GM is good at making things at very high scale,” said Adam Kwiatkowski, executive chief engineer of global electric propulsion systems. “We can vary battery size to do trucks, crossovers, SUVs and cars with low roofs.” GM’s batteries and motors are flexible and interchangeable to be used in a variety of vehicles. GM will make the motors itself, and produce batteries in a sprawling $2.3-billion plant it’s building with supplier LG Chem.

“A 250- to 300-mile range is where people have confidence,” director of global electrification and battery systems Time Grewe said. “We’ve pushed the technology and (battery) chemistry to deliver that.” The battery factory, not far from GM’s closed Lordstown plant in northeast Ohio, is expected to employ 1,100 people and produce millions of battery cells a month.

“We’re not stopping,” Grewe said. “We’re working on the next generation of cells to make them even better.”

You still have to sell them

GM’s history with electric vehicles proves great technology doesn’t necessarily lead to great sales and profits, much less the glowing reputation for social responsibility and innovation Toyota and Tesla get from hybrids and EVs.

GM will have to deliver a new message to new buyers when the EVs start hitting the road with the GMC Hummer SUV next year said John Voelcker, a journalist specializing in EVs and former editor of Green Car Journal.

“If GM’s top marketing people view EVs as a niche, that’s a problem,” Voelcker said.

“Will GM market them as new EVs or as new, better vehicles? Will they simply say, this vehicle has incredible acceleration, wins every stop-light grand prix with no guilt, never needs to go to the gas station and is quiet and smooth?

“Talking about them like niche vehicles limits their audience.”

Contact Mark Phelan at 313-222-6731 or [email protected]. Follow him on Twitter @mark_phelan. Read more on autos and sign up for our autos newsletter.

Read or Share this story: https://www.freep.com/story/money/cars/mark-phelan/2020/03/28/gm-electric-vehicle-technology-big-profits/5085667002/