JinkoSolar (JKS) has become one of the largest solar manufacturers in the world. The company has recently seen its share prices surge as a result of improving financials. In an industry where even top manufacturers like SunEdison routinely collapse as a result of extreme competition, JinkoSolar’s rise is impressive. Despite the US-China trade war, JinkoSolar continues to experience success.

JinkoSolar’s move towards higher efficiency solar products has been key to the company’s recent success. By differentiating from lower efficiency commodity manufacturers, JinkoSolar is improving its long-term prospects. JinkoSolar’s strong Q3 further validates the company’s move towards high-quality mono-crystalline products. The solar industry may be entering a new phase where high-tech manufacturers have a noticeable advantage over commodity manufacturers.

Technological Transition

The solar industry has long been dominated by cheaper low efficiency manufacturers. This dynamic may be changing as the industry appears to be transitioning from multi-crystalline products to mono-crystalline products. The current trend of industry consolidation indicates that solar panel quality and reliability are becoming more important factors for consumers. This, in part, explains why JinkoSolar has been successful in its transition to mono-crystalline solar products.

Mono-crystalline panels have higher efficiency rates than multi-crystalline panels and thin-film panels. This is not surprising as mono-crystalline panels use the highest grade silicon in their production. While mono-crystalline panels are more expensive, the higher-quality gained from using mono-crystalline appears to be worth the cost.

Moreover, mono-crystalline panels allow for more flexibility in accessing different solar markets. Given that smaller solar projects have disproportionately high soft costs like installation, higher efficiency mono-crystalline panels holds an advantage on this front. This makes sense as higher efficiency panels simply require less effort to install as they do not take up as much space relative to lower efficiency modules like thin-film panels.

The image below breaks down the costs of different solar segments. Soft costs account for a far bigger percentage of total costs in smaller-scale projects like residential.

Source: National Renewable Energy Laboratory

As solar panel costs continue to plummet, soft costs will make up for an increasingly large percentage of overall costs. This means that higher efficiency mono-crystalline panels could have a significant advantage even in utility-scale solar where soft costs represent a smaller percentage of overall costs. JinkoSolar’s recent success with its mono-crystalline panels is evidence that these higher efficiency panels may be the future of solar.

JinkoSolar started producing mono-wafers in 2016, which means that the company already has years of experience with this technology. In Q3, 75% of the company’s total shipments consisted of mono-based products. The company is not slowing down its transition anytime soon and expects to have mono-based high-efficiency products accounted for virtually all of it shipments in 2020.

JinkoSolar’s high-efficiency technology platform stands in sharp contrast with the common lower efficiency Chinese commodity manufacturer. In fact, the company’s N-type cell recently broke a record with a recorded efficiency of 24.58%. Given that JinkoSolar is one of China’s largest manufacturers with 3,326 MW of shipments in Q3 alone, the company’s technology shift may point towards a larger industry trend.

If the industry continues its shift towards higher efficiency mono-crystalline, it will likely become increasingly hard for newer entrants to compete. Higher barriers of entry brought on by mono-crystalline module manufacturing could relieve some of the downward pressure on margins. As such, it would not be surprising to see JinkoSolar’s gross margins improve even more moving forward.

Mono-crystalline modules like the one shown below have many advantages over mono-crystalline and thin-film modules.

Improving Financials

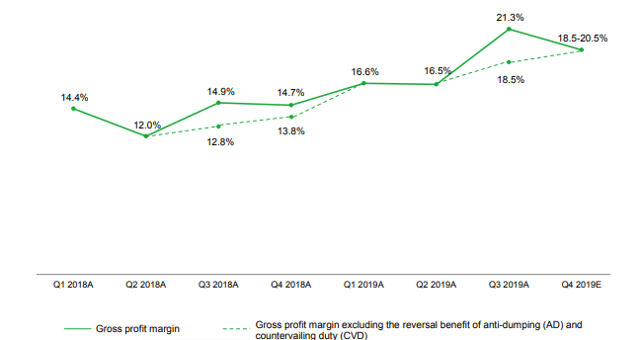

JinkoSolar’s mono-crystalline products have positively impacted the company’s financials in recent quarters. While JinkoSolar did not experience any major growth on the shipments front, the company is improving its margins. JinkoSolar recorded gross margins of 21.3% in Q3 compared to 60.5% in Q2. This Q3 gross margin represents an even larger jump when compared to the company’s 2018 Q3 gross margin of 14.9%.

JinkoSolar also reported a quarterly net income of $50.9 million. As JinkoSolar continues to improve its technology and diversify to higher-margin markets, the company’s net income should grow over the next few quarters. JinkoSolar has a solid growth path ahead in spite of the US-China trade war. The company has shown a great deal of resilience in the face of tariffs much to the surprise of many analysts.

The graph below clearly shows that JinkoSolar’s gross profits are trending upward.

Source: JinkoSolar

Potential Headwinds

Module manufacturing has always been a volatile and unpredictable industry. While JinkoSolar is currently leading the industry on many fronts, the company’s success is by no means assured. History has shown that even leading solar companies can collapse seemingly overnight. Given the rising tensions between the US and China, Chinese module manufactures like JinkoSolar are at even greater risk.

A simple increase in tariffs can have an outsized impact on JinkoSolar. With how US-China relations are progressing, it is not unlikely that the trade war could worsen to the detriment of JinkoSolar. Moreover, JinkoSolar operates under different rules given the Chinese government’s control over its industries. This is both a positive and a negative for JinkoSolar as the Chinese government could funnel resources to support JinkoSolar or cut support on a whim. There’s far more to consider when looking into JinkoSolar than just traditional market pressures.

Conclusion

Although JinkoSolar is surging as of late, investors should still be wary about the unpredictable trade situation between China and the US. As JinkoSolar is one of the largest Chinese solar manufacturers, the company has much to lose if trade relations worsen. However, JinkoSolar has a better chance than most at weathering tariffs given the company’s industry-leading cost structure and improving technology.

JinkoSolar’s successful technology transition should help drive record profits moving forward. Moreover, JinkoSolar is successfully diversifying to markets outside of China, including emerging markets like the Middle East and Eastern Europe. The company has more upside at its current market valuation of $1 billion and forward P/E ratio of 8.4.

Solar inverter companies like SolarEdge (SEDG) and Enphase (ENPH) have recently emerged as industry powerhouses for good reason. These companies are able to take advantage of solar demand growth without experiencing the downsides of module manufacturing. JinkoSolar is one of the few solar manufacturers that can still bring value to investors. The company is at the forefront of a technology trend that could shift solar manufacturing towards higher efficiency modules. JinkoSolar is definitely an attractive investment given its low cost structure, industry-leading technology, and broader reach.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.