TLDR: All told, Americans cross-subsidize health care for unauthorized immigrants to the tune of $17.0 billion a year. Federal taxpayers provided $10.0 billion in subsidized care to unauthorized immigrants in 2019. The total amounts to $1,615 per unauthorized immigrant, imposing a burden of $51 per U.S. resident.

Current federal policy is to prohibit federal tax funding of health care to unauthorized immigrants through either Medicaid or Obamacare. Two years ago, I did a deep dive showing that despite these statutory prohibitions, Americans nevertheless provided at least $18.5 billion in subsidized health services for unauthorized immigrants in 2016. Today I want to explore whether that reality has appreciably changed under the Trump administration.

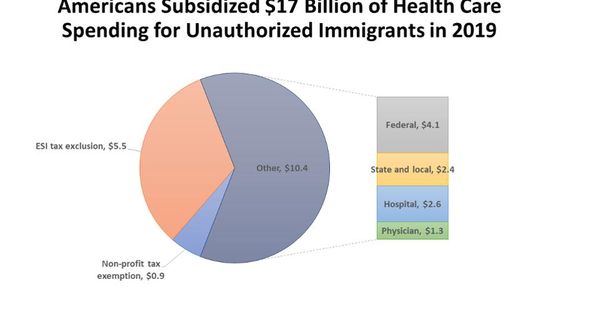

Nevertheless, rough estimates suggest that the nation’s 4.1 million uninsured immigrants who are unauthorized likely receive about $4.1 billion in health services paid for by federal taxes, $2.4 billion in health services financed by state and local taxpayers, another $2.6 bankrolled through “cost-shifting” i.e., higher payments by insured patients to cover hospital uncompensated care losses, and roughly $1.3 billion in physician charity care. In addition to these amounts, unauthorized immigrants likely benefit from at least $0.9 billion in implicit federal subsidies due to the tax exemption for nonprofit hospitals and another $5.5 billion in tax expenditures from the employer tax exclusion.

All told, Americans cross-subsidize health care for unauthorized immigrants to the tune of $17.0 billion a year . Of this total, federal taxpayers provided $10.0 billion in subsidized care to unauthorized immigrants in 2019 .

Americans Subsidized $17 Billion of Health Care

In this post, I describe in more detail current policy, current sources of funding for health care of unauthorized immigrants. In a previous post, I offered four independent reasons federal tax funding for such care is a bad idea (that is, a reader need only accept one, not all, in order to conclude we should dispense with such funding).

Current Policy Regarding Federal Funding of Health Care for Unauthorized Immigrants

The purported intent of federal policy is to prevent federal tax dollars from being used to fund health care for unauthorized immigrants except in extreme circumstances. Notwithstanding express prohibitions contained in the statutes related to Medicaid and Obamacare, there also are companion federal programs that permit federal funding to be used for health care of unauthorized immigrants indirectly. While the Trump administration has taken various steps to reduce the number of unauthorized immigrants, there have been no overt changes in policy regarding use of federal funds to finance health care for such individuals. Thus, what follows is largely unchanged from my post from two years ago.

Where Use of Federal Dollars to Fund Health Care for Unauthorized Immigrants is Expressly Prohibited

Medicaid. Under Medicaid and CHIP (Children’s Health Insurance Program), no federal funding may be used to cover unauthorized immigrants, except for payment for limited emergency services. Specifically, “Medicaid payments for emergency services may be made on behalf of individuals who are otherwise eligible for Medicaid but for their immigration status. These payments cover costs for emergency care for lawfully present immigrants who remain ineligible for Medicaid as well as undocumented immigrants.”

Moreever, states can and do use state-only Medicaid programs to cover such individuals. For example, California’s Health for All Kids Act provides unauthorized immigrant children with access to coverage through Medi-Cal, the state Medicaid program. Its passage in 2015 made California the largest state to use state-only funding to provide coverage to all children regardless of immigration status; in doing so, it joins New York, Illinois, Massachusetts, Washington, and the District of Columbia.

ACA. Under the ACA, immigrants must be lawfully present to purchase insurance in a Qualified Health Plan, or to be eligible for an Advance Payment for Premium Tax Credit or Cost-Sharing Reduction. Under legislation signed by Governor Jerry Brown in June 2016, California would have been the first state to allow unauthorized immigrants to purchase health plans through its insurance exchange without fear that their information would be shared with other government agencies. The law directed California’s exchange, Covered California, to apply for a State Innovation Waiver to allow people who would be eligible for the exchange if not for their immigration status to purchase California Qualified Health Plans (QHPs), which provide benefits identical to those included in other ACA-compliant QHPs. This policy requires a waiver because it involves an alteration to the original terms of the ACA, which bars the participation of unauthorized immigrants in state exchanges. However, this waiver request was withdrawn on January 18, 2017.

Where Use of Federal Dollars to Fund Health Care for Unauthorized Immigrants is Indirectly Permitted

The “clear intent” of restrictions embedded in Medicaid and Obamacare is undercut by several end-arounds that allow health care for unauthorized immigrants to be indirectly funded using federal dollars.

Medicaid DSH Payments. First, there is a source of Medicaid financing that indirectly benefits unauthorized immigrants: DSH payments [2]. Kaiser Family Foundation reports “DSH, or “disproportionate share” hospitals are hospitals that serve a large number of Medicaid and low-income uninsured patients…At the facility level, Medicaid DSH payments are limited to 100 percent of the costs incurred for serving Medicaid and uninsured patients that have not been compensated by Medicaid (Medicaid shortfall).” The DSH program simply provides a general subsidy against a hospital’s aggregate uncompensated care losses from uninsured patients. Nothing requires hospitals to back out their spending on uncompensated care for unauthorized immigrants from their aggregate losses; consequently, federal Medicaid funds end up indirectly subsidizing their care even though it would be expressly illegal to pay for their care by making them direct Medicaid recipients.

Medicare DSH Payments. In a similar fashion, although the formula is much more complicated, Medicare also pays hospitals a DSH payment that effectively serves as a general subsidy to offset aggregate uncompensated care losses without making any distinction between uncompensated costs generated by unauthorized immigrants and those generated by American citizens or legal immigrants.

Community Health Centers. Federally qualified health centers provide primary healthcare, dental, mental health and pharmacy services. They treat all comers without concern for immigration status or ability to pay for care.

Tax Exemption. Nonprofit hospitals (and other health facilities) receive tens of billions of dollars annually in benefits from the federal tax exemption including forgone taxes, public charitable contributions, and the value of tax-exempt bond financing. Unauthorized immigrants benefit from this federal largesse.

Employer Tax Exclusion. The employer tax exclusion provides an indirect federal tax subsidy to everyone with employer-sponsored health insurance. Noncitizen immigrants are admittedly less likely to have such coverage than natives, but the differential is less than 10 percentage points after adjusting for the most important demographic/socioeconomic characteristics.

From where I sit (a libertarian-leaning conservative health reformer), current policy makes a lot of sense. It allows states or localities to opt to provide health care for unauthorized immigrants using local tax resources. In a country of 330 million people with deeply divided views on this issue, the federalist approach seems far preferable to trying to adopt a one-size-fits-all policy that forces tens of millions of federal taxpayers to subsidize lawbreakers against their will.

Moreover, my view is that if the intent of federal policy is to prevent taxpayer resources from being used to finance health care for unauthorized immigrants, federal officials have an obligation to be vigilant this does not occur inadvertently and a parallel obligation to be transparent if it does. That was the purpose of my writing an earlier post on this issue 20 months ago.

Current Funding for Health Care of Illegal Immigrants

Uninsured Unauthorized Immigrants. According to Pew Research Center, there were 10.5 million unauthorized immigrants in the U.S. in 2017. This is the latest figure available and smaller than the 11.3 million figure I used to develop my 2016 estimate of spending on health care for unauthorized immigrants.

Currently, 14.9% of the non-elderly uninsured (4.1 million) are unauthorized immigrants who are ineligible for both Medicaid and ACA coverage under federal law. For purposes of discussion, I am going to focus principally on financing health care for unauthorized immigrants who are uninsured since we know that about 70% of care for America’s uninsured is uncompensated, meaning that ultimately it is paid for by society in one way or another.

In 2013 (the latest available such figures), America’s uninsured generated $84.9 billion in uncompensated care costs [Table 2] or $1,257 per person who was ever uninsured that year [Table 1]. Of this:

- 39% was covered by various federal programs (e.g., disproportionate share payments to hospitals);

- 23% by state and local governments (e.g., via taxpayer support of state and locally owned hospitals);

- 12% came in the form of physician charity care covered;

- 25%—was covered by hospitals (arguably by “cost-shifting” i.e., higher charges to privately insured patients that effectively cross-subsidize care for patients who do not pay full freight etc.). An unknown fraction of this stems from EMTALA—the Emergency Treatment and Active Labor Act—a federal law that requires hospitals to treat emergency patients regardless of their ability to pay. EMTALA is an example of “taxation by regulation” insofar as the same outcome might have been achieved by using tax dollars to pay hospitals to treat such patients voluntarily.

Between 2013 and 2018, the average daily uninsured rate declined by 35% (dropping from 14.4% to 9.4% according to the National Health Interview Survey). One might suppose that uncompensated care levels would decline in direct proportion. However, according to the American Hospital Association, hospital uncompensated care declined only 18% between 2013 and 2017 even though the average daily uninsured rate declined by 37% during the same period. In the shorthand of economists, the elasticity of uncompensated care spending with respect to uninsured risk is .5: for every 10% change in uninsured risk there is only a 5% reduction in uncompensated care spending.

Using this elasticity estimate to the observed change in uninsured risk from 2013 to 2018, I have estimated there was a 16.9% reduction in uncompensated care spending between 2013 and 2019. Assuming this reduction was the same across each of the four components and that unauthorized immigrants received a pro rata share of such support (i.e., 14.9%), they account for the $10.5 billion in uncompensated care costs in 2019, financed as follows:

- $4.1 billion—federal taxpayers

- $2.4 billion—state and local taxpayers

- $2.6 billion—hospital charity care/bad debts arguably cost-shifted to private patients

- $1.3 billion—physician charity care

I recognize these back-of-the-envelope figures are crude, but they are the best estimates I could make given that the recent (2017) National Academy of Sciences report The Economic and Fiscal Consequences of Immigration only provides highly aggregated estimates of cost impacts, with no breakdown of how much of these costs can be attributed to health care etc.

Federal Taxpayers. It might puzzle some readers that the federal government is paying for any care for unauthorized immigrants in light of federal policy. This can happen through fraud, to be sure, but as explained earlier, most of this occurs indirectly through various federal programs that fund institutions rather than individuals. These include hospitals (Medicaid/Medicare DSH payments) and community health centers/free clinics.

Hospital Charity Care/Bad Debts. Hospitals with 501(c)(3) status are required to establish written financial assistance policies under Affordable Care Act sections 501(r). As a consequence, there is a cleaner distinction between genuine charity care and bad debts than there was in the past when hospitals adopted very disparate practices about how to treat situations where a patient was not expected to pay (charity care) versus not able to pay (bad debt).

Let me concede that there is only limited evidence that hospitals engage in what’s called “dynamic cost shifting.” That is, if a hospital’s uncompensated care burden rises by $1 million, only some, not all, of that amount can be expected to be recovered by the hospital’s increasing charges to privately insured patients to make up the difference.

That said, hospitals can and do exercise market power, meaning they are able to charge private patients a higher rate than Medicare or Medicaid patients. This practice results in profits from private patients that then are used by the hospital in various ways, including the provision of charitable care.

The point being that if the federal government eliminated whatever payments it now makes for uncompensated care (including that generated by unauthorized immigrants), hospitals hypothetically would not respond by increasing charges to recover part of their increased uncompensated care costs, but instead make adjustments in the form of either spending less on other things or taking steps to discourage unauthorized immigrants from showing up at their doors.

Conversely, if federal, state or local governments were to make hospitals entirely whole regarding their uncompensated care losses to unauthorized immigrants, this would not necessarily benefit hospital patients in the form of lower charges. For these reasons, it is not altogether obvious that these hospital uncompensated care losses are a problem that can be solved by better public policy. Nevertheless they manifestly are a public policy issue from the standpoint of patients concerned about high health costs.

Physician Charity Care. The $1.3 billion in physician charity care represent an average of $1,414 for each of the country’s 893,000 active physicians. According to Medscape’s Physician Compensation Report for 2017, the average physician makes $294,000 a year. Even generously assuming a 60 hour workweek, that’s roughly $100 hourly meaning the average physician devotes 14.1 hours a year to charity care for unauthorized immigrants (less if we assume a higher hourly rate).

Note that physicians, receive no tax benefits for providing charity care; that is, they cannot write off the cost of charity care from their personal or business taxes. Consequently, although physician charity care is an important component of the uncompensated care landscape, in my view, these voluntary donations of time—a longstanding worthy tradition in American medicine—do not pose a public policy concern.

Other Federal Subsidies Benefiting Unauthorized Immigrants

Although it presumably did not arise by a deliberate intent to benefit unauthorized immigrants, current tax policy likely confers an additional $6.4 billion in additional benefits financed by U.S. taxpayers. The tax exemption for nonprofit hospitals (and any other nonprofit health facilities) benefits unauthorized immigrants regardless of their insurance status. The employer tax exclusion benefits unauthorized immigrants who happen to receive employer-provided health benefits.

Tax Exemption. The value of the nonprofit tax exemption to U.S. nonprofit hospitals in 2019 was approximately $28.7 billion, including forgone taxes, public charitable contributions, and the value of tax-exempt bond financing. Assuming that 10.5 million unauthorized immigrants receive a pro rata share of this benefit, they receive roughly $0.9 billion in additional federal subsidies for their hospital care. I could locate no parallel figures for other nonprofit health facilities.

Employer Tax Exclusion. Estimating the size of these tax benefits for unauthorized immigrants is of necessity extremely rough. I could locate no reliable information on the wage distribution of such immigrants, especially among those who obtain employer-provided health benefits. According to Kaiser Family Foundation, “nonelderly lawfully present and unauthorized immigrants are as likely as nonelderly citizens are to live in a family with at least one full-time worker, but they are more likely than citizens are to be low-income, since they often work in low-wage jobs.” More concretely, nearly half (48%) of unauthorized immigrants live in low income families below 200% of the federal poverty level.

That said, as shown earlier, we know that only 4.1 million of 10.5 million unauthorized immigrants are uninsured, leaving 6.4 million with some sort of coverage. No good data exist on what fraction of these obtain non-group health coverage, but Kaiser Family Foundation’s Larry Levitt has said via Twitter that “some are buying non-group, but I’d agree that it’s primarily employer coverage.” Assuming that 91% have employer-provided coverage (which is the identical percentage among all non-elderly adults having private coverage in 2018 [1]) this would equal 5.8 million unauthorized immigrants with such coverage.

And even if we conservatively assume that such workers obtain less expensive coverage from an employer with many low-wage workers, the single premium in 2019 would be $6,189 (compared to $7.188 across all plans/industries [Fig. 6.16]). If we further conservatively assume all unauthorized workers pay no income taxes and are only liable for payroll taxes, the tax subsidy amounts to 15.3% ($947 per worker) or $5.5 billion for all unauthorized immigrants with such coverage.

Conclusion

When we sum all the figures, including $10.5 billion for the uninsured and another $6.5 billion in tax subsidies, we arrive at a grand total of $17.0 billion in subsidized health care for all unauthorized immigrants in 2019. These figures are much easier to grasp on a per capita basis:

· This amounts to a benefit of $1,615 per unauthorized immigrant

· It imposes a burden of $51 per U.S. resident.

The share that concerns me the most—$10.0 billion borne by federal taxpayers—amounts to $951 per unauthorized immigrant or $30 per U.S. resident. Admittedly, one could argue that since the amounts at stake are so small, this is not an issue worth fighting about. However, it is precisely that sort of thinking that has led us to today’s dismal reality that unfunded liabilities facing Uncle Sam now are roughly $200 trillion and rising.

So even though the dollar stakes are quite small in a federal budget that now spending at a rate of $4.8 trillion a year, I believe citizens and federal policymakers should stop pressing the Easy button and seriously ponder four important principled arguments against federal tax financing of health care for unauthorized immigrants:

- Federal funding is unnecessary

- Federal funding is inefficient

- Federal funding is unconstitutional

- Federal funding is immoral

I elaborate on these arguments in a previous post: Why Federal Taxpayers Should Not Fund Health Care For Unauthorized Immigrants.

___________________________________________________________

READ CHRIS’ BOOK, The American Health Economy Illustrated (AEI Press, 2012), available at Amazon and other major retailers or as a pdf at AEI.

Follow @ConoverChris on Twitter, and The Apothecary on Facebook. Or, sign up to receive a weekly e-mail digest of articles from The Apothecary.

Follow me on Twitter.