According to current portfolio statistics, the three major technology holdings of Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) are Apple Inc. (NASDAQ:AAPL), VeriSign Inc. (NASDAQ:VRSN) and StoneCo Ltd. (NASDAQ:STNE).

The information technology sector includes companies that design, develop and retail computer operating systems, applications and consumer electronics. The sector contains three industry groups: software, hardware and semiconductors.

0c9c4a2861646617e395f96e99a6bd78.png

Guru and sector overview

Berkshire adapts a four-criterion approach to investing: Buffett and co-manager Charlie Munger (Trades, Portfolio) seek companies that have an understandable business, favorable growth aspects, are operated by honest and competent management and available at attractive prices. The Buffett-Munger Screener, a GuruFocus Premium feature, lists the companies that follow Berkshire’s investing criteria.

444d937c307b4b03a622127efb552d93.png

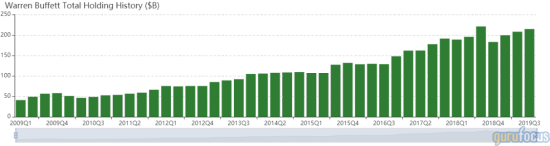

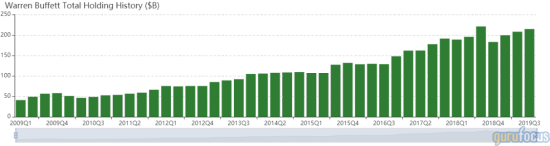

As of September quarter-end, the technology sector occupies 27.33% of Berkshire’s $214.67 billion equity portfolio, with Apple occupying 25.96% of the equity portfolio.

4dccc66eb9e9eda18b066f25ae79540b.png

Apple

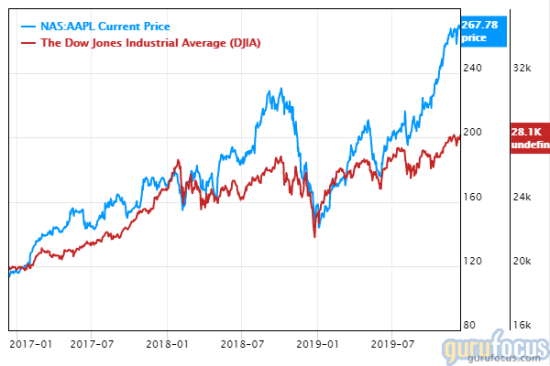

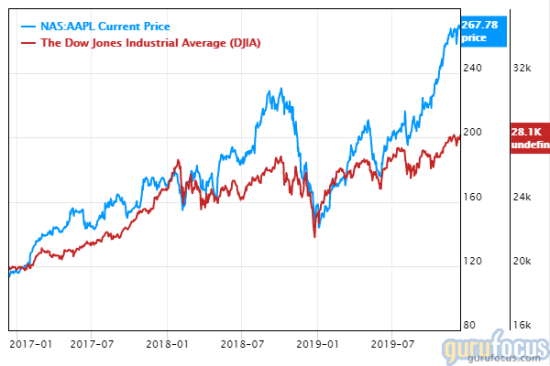

Buffett’s conglomerate owns 248,838,679 shares of Apple, down a slight 0.3% from the fourth-quarter 2018 stake of 249,589,329 shares. While shares averaged $209.04 during the quarter, the stock closed at $275.15 on Friday, up 1.36% from Thursday’s close and a new all-time high.

2eedee50f09e50fc9e304739da2f6675.png

On Friday, the U.S. and China agreed to a trade deal, which included “tariff relief, increased agricultural purchases and structural changes to intellectual property and technology issues” according to CNBC sources. President Trump said in a series of tweets that while the White House will leave tariffs of 25% on $250 billion in imports, the administration will trim duties on $120 billion in imports to 7.5% and cancel the 15% tariffs on $160 billion in Chinese consumer goods like toys, electronics and clothing, which would have taken effect on Sunday.

Wedbush analyst Daniel Ives said in a note that the 15% tariffs on consumer electronics represented a “dark cloud” hanging over the technology space as such tariffs would have impeded the supply chain and demand for Apple’s products during the holiday quarter. With the tariffs now off the table, Ives sees a “green light” for technology stocks like Apple to have a strong December quarter, given upside potential in its products like the iPhone and AirPods. By striking a phase-one trade deal with China, Trump “delivered an early Christmas present” to Apple and its investors.

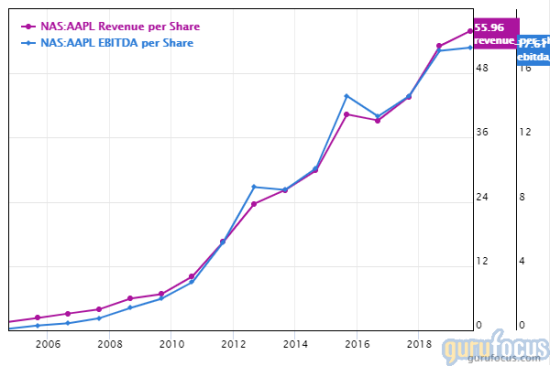

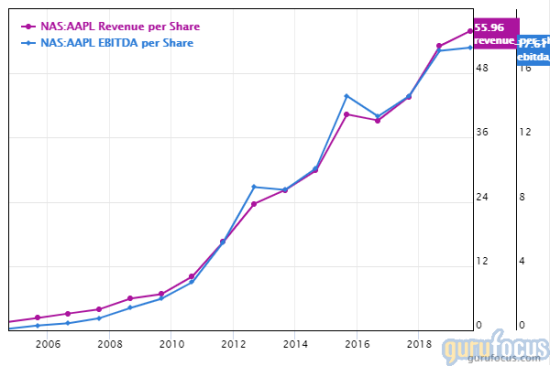

GuruFocus ranks the Cupertino, California-based tech giant’s profitability 10 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and operating margins that are outperforming 96.73% of global competitors despite languishing near a 10-year low of 24.57%.

eff5bba3896db0783dc5d45843339377.png

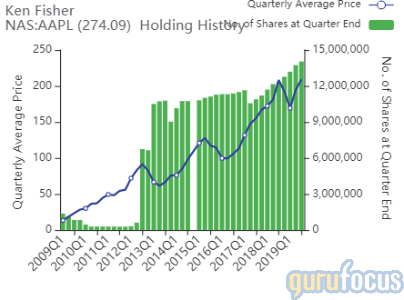

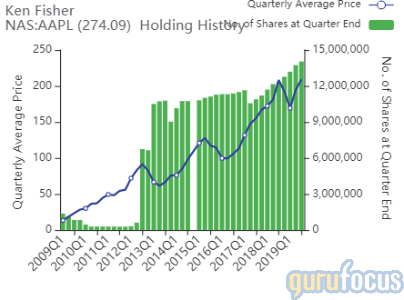

Other gurus cheering on Apple include Ken Fisher (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio) and Spiros Segalas (Trades, Portfolio).

303a5c34ff56fe0ad15440b856dd8b58.png

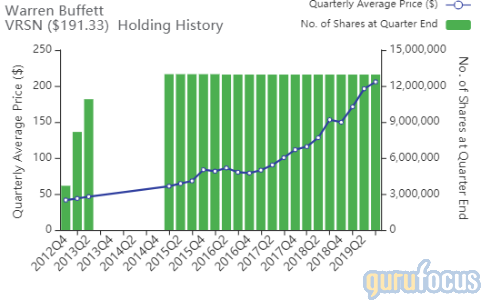

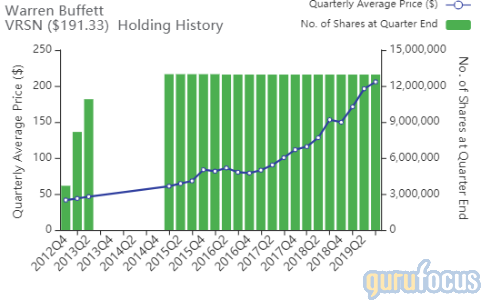

VeriSign

Berkshire owns 12,952,745 shares of VeriSign, giving the position 1.14% weight in the equity portfolio.

451bf4ed9c453d5a93ff32b550bceeb0.png

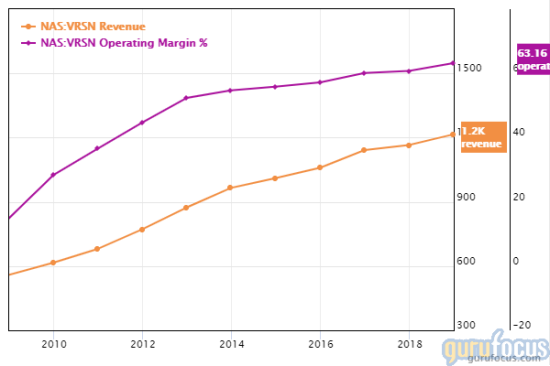

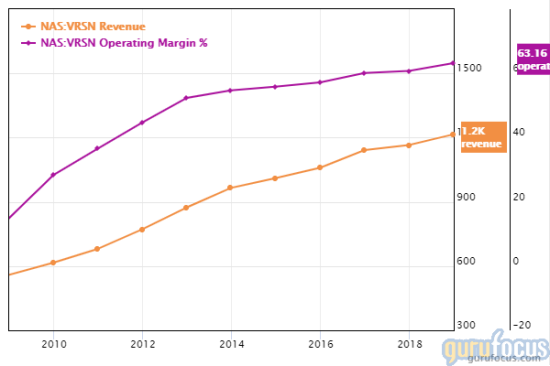

The Reston, Virginia-based company operates a registry for top-level domains like .com and .net. GuruFocus ranks VeriSign’s profitability 10 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, a 3.5-star business predictability rank and operating margins that have increased approximately 3% per year over the past five years and outperform over 97% of global competitors.

b9107985664f9c34aafd9f4eb276ce64.png

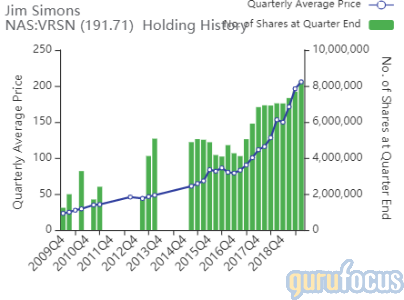

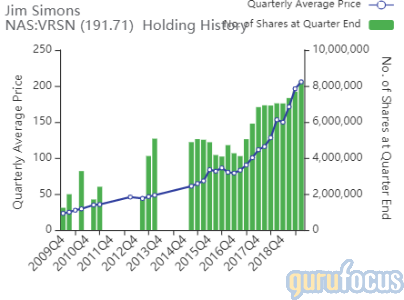

Other gurus with holdings in VeriSign include Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Ron Baron (Trades, Portfolio)’s Baron Funds.

15c3eb1808c38cce66de80d4df6accaf.png

StoneCo

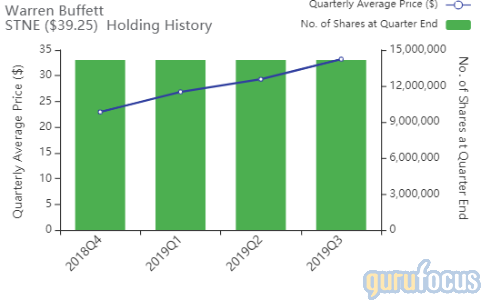

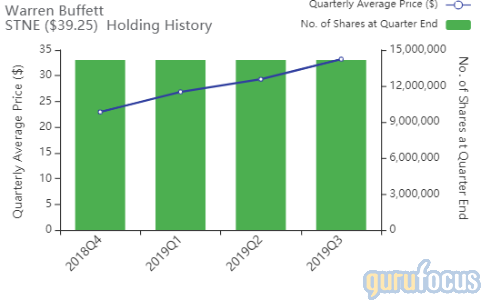

Berkshire owns 14,166,748 shares of StoneCo, giving the holding 0.23% weight in the equity portfolio.

7b0718a6549ad992817027f23745bbda.png

The Sao Paulo, Brazil-based financial technology solutions provider said on Nov. 21 that the company reached a total base of 428,900 active clients and continued the rollout of new services, including an integrated financial platform in the first quarter of 2020. Revenues of 671.1 million reals ($163.22 million) increased 62.1% year over year, driven primarily by a 48.9% increase in total payment volume and higher take rate.

Disclosure: No positions.

Read more here:

- 4 Health Care Stocks Gurus Broadly Own

- Charles de Vaulx’s Top 5 Buys of the 3rd Quarter

- Brandes Investments’ Top 5 Buys in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.