Technology is the application of science into the practical world, which simplifies the lifestyle of an individual. In almost all the sectors in the current scenario, there is an application of the technology. Few examples of technology include smartphones, personal computers, tablets, nanotechnology, Artificial Intelligence, Blockchain, etc.

In this piece of article, let’s look at three IT stocks and the technology they use along with their recent announcements.

Dotz Nano Limited

About the Company:

The information technology sector company, Dotz Nano Limited (ASX: DTZ) is known as the technology leader. The company focuses on the development as well as the marketing of innovative advanced carbon-based materials, which are applied for tracing, anti-forging and product-liability solutions.

Placement of $1 million Update:

On 23rd July 2019, Dotz Nano Limited announced that it had received $1 million before costs through the share placement from the sophisticated and professional investors. The funds raised through this placement will provide support to the company in progressing its commercialisation activities, which include completing advanced commercial engagements with probable clients from the high-value fuel as well as fracking industries.

The placement includes an offer of ~16,129,033 fully paid ordinary shares in the company at an issue price of $0.062 per share, inclusive of 1 for 2 attaching unlisted option, which will have a validity of two years and exercisable at 9 cents per option.

The proceeds through the placement will also support the company to pursue opportunities in cannabis, plastics space and lubricants. It will also help the company in increasing its activities related to sales and marketing as well as advancing towards research and development.

Subsequent to the completion of the successful placement, Uzi Breier, the CEO of Dotz Nano Limited thanked the existing as well as the new shareholders for their support in the placement and their trust in the company’s end-to-end verification technology and its ability to execute on the new go-to-market strategy.

Mr Breier also highlighted that the company made substantial development by focusing on end-user in its major markets. Additionally, pilot testing as well as proof of concepts are a standard practice followed by the companies and within its targeted market, many of the customers are looking for customisation.

Also, the end-to-end technology of the company is capable of getting inserted into a variety of materials like plastic and bulk liquids without hampering the properties or appearance of the end product.

Stock Performance:

The stock of DTZ has provided a negative return of 4.82% for the past six months. The shares of DTZ on 24th July 2019 (AEST 1:15 PM) were trading at $0.060, down 6.25%. DTZ holds a market cap of $13.96 million, with ~218.17 million outstanding shares.

HomeStay Care Limited

About the Company:

HomeStay Care Limited (ASX: HSC) with its intelligent home platform allows elderly Aussies and people with disabilities to stay independently in their own house for a longer time. The company provide solutions which have sensors attached across the home. It has unique software applications as well as data analytics, which help these people to remain linked to the family, friends and carers.

B2C Market Offer and HomeStay Connect App Launch Update:

On 23rd July 2019, HomeStay Care Limited announced the launch of the business-to-consumer (B2C) go-to-market offer, which will allow the users from aged care and disability sectors to buy technology solutions directly from the company’s webstore.

HomeStay webstore is the key feature in brand-new B2C channel. It comprises of an easily navigable website for the consumers, their family and friends for reviewing the products as well as select an expanded range of products, at the same time buy the technology solutions as per their requirement.

Webstore is a user-friendly mobile-optimised digital platform. It has high-resolution images and videos of the products with technical description, tutorial about the products capability and suitability, special offers, related items along with related products from the company’s partners.

The company also launched its HomeStay Connect App, which is a user interface with the technology solutions used in the Intelligent Home. This app provides improved user experience, further insights, and the ability to interact in real-time with the user’s loved ones as well as carers instantly. Thus, making its customers more independent.

HomeStay Connect app is also capable of providing the activities of the client as well as instant alerts for the loved ones and carers through smartphones, tablets and personal computers. It also has additional features like instant calling to the emergency contacts, SMS, alert log and email notification.

The updated version of this app can be personalised, which will help the users to use the functionality of the app as per their independence and information need. Thus, providing a real-time understanding of the daily routine of the users and also allowing the carers to assist the client effectively and efficiently with increased peace of mind.

Stock Performance:

The shares of HSC have provided a negative return of 47.37% in the last six months. The shares of HSC on 24th July 2019 (AEST 1:30 PM) were trading at $0.020. The shares continued to trade flat on ASX. HSC has a market cap of $13.9 million and ~695 million outstanding shares.

Family Zone Cyber Safety Limited

About the Company:

Family Zone Cyber Safety Limited (ASX: FZO) is an ASX-listed company focused on cyber safety, fulfilling the growing demand to keep children safe online as well as manage digital lifestyles. Against this backdrop, the company has developed an innovative and cloud-based solution, integrating Australian innovation with top global technology.

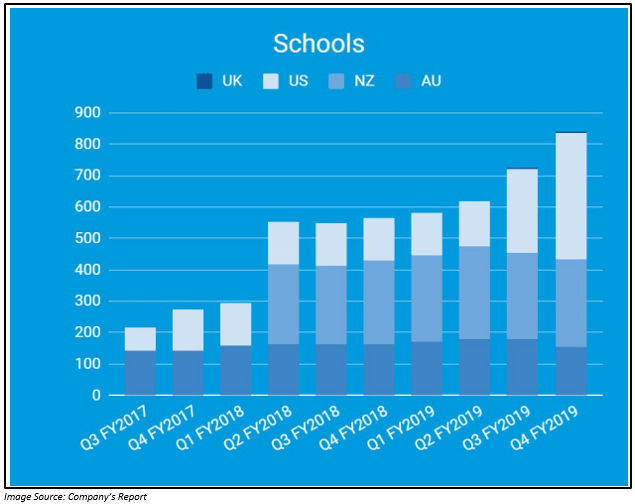

The innovative cyber platform has been the choice of more than 180 premier schools in Australia and is used by 200k+ families every day.

USA Patent Update:

On 23rd July 2019, Family Zone Cyber Safety Limited provided the market an update on the progress related to its intellectual property.

In its IPO prospectus released in the year 2016, the company highlighted that it had started a deliberate program for developing as well as securing pertinent intellectual property. On 23rd July 2019, the company has been awarded a patent related to its “Device Management System” under application 15/286434 from the US Patent & Trademark Office, which was filed in the month of March 2013.

A Device Management System is a Universal Cyber Safety Platform that will be used for managing the usage the user devices’ Internet use. The management of usage of the mInternet will be based on access policies, which are imposed through technology. It can also be installed in user devices as well as mobile networks or any network gateways.

The patent for the Universal Cyber Safety Platform is a significant milestone for the company as its platform approach to cyber safety will help it in revealing the global potential of parental controls. The market for parental controls is assumed to be around $100 billion, with a huge scope for entry into the market, as hardly less than 5% of the market is penetrated.

The company is targeting this market by providing the parents as well as the schools with a capability to cooperate and use their rules across any network and any gadget. The company claims that the model is effective as well as scalable based on the trials and operational experience.

Further, the company will continue to look for global patent registration via international PCT process.

Clarification to the Announcement on 9th July 2019

On 23rd July 2019, the company also provided clarification to one of the misstatements in the announcement released to the market on 9th July 2019. In the highlights section of the announcement, the company mentioned that there was a growth rate of 175% in the USA school footprint for a period of three months. The number of months part contained an error, which should have been six months instead of three months.

Stock Performance:

The shares of FZO have provided a decent return of 29.41% for the past six months. The stock of FZO on 24th July 2019 (AEST 2:30 PM), was trading at $0.240, down 4%. FZO has a market cap of $50.16 million, with ~200.63 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

Start discussion with value Investors for ASX Stock Market Investment and Opinion.

6 Cannabis Stocks under Investor’s Limelight…

Cannabis companies that sell both medicinal weed and recreational pot. Marijuana stocks to look at. Marijuana mergers and acquisitions. Dispensary data analytics. Upcoming marijuana IPO’s

Those phrases have become increasingly common as marijuana legalization spreads.

Global spending on legal cannabis is expected to grow 230% to $32 billion in 2020 as compared to $9.5 in 2017, according to Arcview Market Research and BDS Analytics. As of June 29, 2018 the United States Marijuana Index, despite a lot of uncertainty around regulations, has over the past 1 year gained 71.49%, as compared to about 12% gain seen by the S&P 500.

Click here for your FREE Report