Prologue

Over the past year, the American health system has undergone a radical transformation: Direct-online consumer access. Many new players and start-ups have entered this growing arena, which is thriving and bubbling as a result of money (investors) and transactions (mergers) pouring in.

In this article we will take a closer look at the background of this story, as well as discuss how investors may benefit from this developing trend.

Stats

Let’s start with some numbers.

- Health expenditure in the US is closing fast on $4 trillion a year, or 18% of GDP. In ten years, this percentage is expected to rise to ~20% of GDP.

- The average American family spent $ 28,166 in 2018 on healthcare services, up 20% from 2014.

- During the 20-year period, between 1996 and 2016, US health expenditure increased by 105% while inflation rose by only 55%.

Some call it “pure insanity,” others a “huge problem.” After reading this article, you might wish to add “an investment opportunity.”

The sharp rise in the cost of prescription drugs is one of the most acute issues that the health system deals with. We are talking here about an annual increase of 8-13% in the years 2014-2016, which moderated to 5-7% in subsequent years. Either way, we are looking here at growth rates that are doubling, tripling, and even quadrupling the inflation and/or wage growth rates.

Chronic diseases are the main driver behind the overall rising cost, accounting for about 84% of the total expenditure.

Digitization

The diagram below, taken from the “Rise of Digital Challengers” paper that was prepared by the consulting firm McKinsey, shows where the health sector is located when it comes to two dimensions: Current level of digitization (Y-axis), and the potential to see more automation across the sector (X-axis).

As you can see, the health sector is far behind, occupying a seat in the “more challenged” classroom, with other “students”/sectors such as education and government services.

Sectors where not only the level of digitalization is low, but also the potential for more automation is small, are drawing less attention, and naturally deem less attractive.

Allow me to reveal that the McKinsey paper is from 2018, and it’s focusing on Central and Eastern Europe. Why do we bring it then? Because this is exactly where the US health sector was not so long ago.

Until a few years ago, it was hard to imagine a bright future for the American health system, but it was clear that something significant must happen soon, otherwise the system would be at risk of collapse.

Just to make it clear, we are not talking here about the political aspects of the health services (e.g. Obamacare – yes or no?). Instead, we are focusing on the overload, technical, and technological aspects of the system. Putting it differently, we’re not discussing how affordable are health services but how accessible and easy-to-obtain they are (even) after you’ve paid for those.

Mobile Revolution

The one thing that has turned the health services upside down is the mobile telephone, or more accurately – the use of smartphones within the healthcare system.

Mobile’s capabilities, that have grown significantly in recent years, have served as the infrastructure for many technological platforms that have been developed while having one common purpose in mind – bringing-shifting certain health services from the public clinic to the private home.

What now seems obvious to many was a radical (not-easy-to-implement) change only a few years ago.

Here are a few examples for areas that have been greatly affected by the mobile revolution:

Tele-Health (Tele-Medicine) – A company like Call9 has developed a virtual care platform that connects on-site emergency-trained first responders with remote emergency medicine physicians. This is enabling some patients to receive treatment at home without fearing that in an emergency event there will be no one to treat them quickly.

Speedy Drug Delivery – One of the things a company like Zipdrug does is to allow sick or elderly people to get prescription drugs directly to their homes. This saves a lot of money, as the time, energy, and costs that patients spent on getting to and from physical treatment centers (for distribution of medication) keep going down. Same goes for the operators (of these centers) that are in need of smaller area and less staff to get the same revenues.

Cardiac Monitoring – The start-up Alivecor is allowing for a basic ECG test that is able to identify symptoms that require intervention to be taken through a mobile phone.

Diabetes Monitoring – Sweetch has developed a mobile app that allows diabetics to follow the main, relevant indicators and alert in case that unusual levels that may require intervention appear. Such an app is saving a lot of time for both the patient and the doctor.

In the chart below you can see how dense is the map of start-ups that provide all sorts of health services through the mobile.

Growing Interest

Naturally, when such a technological transformation takes place, you can bet that tech giants will try to get a big bite out of it. Indeed, tech giants have started to participate in the healthcare mobile revolution already in 2012.

11 companies: Apple (AAPL), Google-Alphabet (GOOG, GOOGL), Microsoft (MSFT), Facebook (FB), General Electric (GE), Intel (INTC), Cisco (CSCO), Oracle (ORCL) and IBM (IBM) – have invested $4.7 billion, between 2012 to 2018, in 209 (!) health-related ideas/deals, with GOOGL and GE leading the pack (when it comes to the money spent).

Some of this money was spent on studies and surveys, trying to identify the next big thing – a future app that has the biggest potential to shift work/tasks from the doctor/clinic to the cheaper, and more efficient, mobile platform.

It’s clear that any app that can save a patient even half an hour of waiting time, alongside 5-10 other patients who have all sorts of diseases/germs, is already the beginning of something small that can turn big.

The Primary Care field, for example, has been identified at a very early stage as one of the biggest promises when it comes to simply health, mobile-based, solutions.

Instead of John, “the hypochondriac,” Doe paying a weekly visit to the clinic, complaining about all sorts of “suspicious aches,” we can now offer him to go to the app, whenever he wishes to (not only weekly…).

Instead of the doctor sending John home with a smile, telling him “that’s nothing, my friend… you have many more years left… do not worry… take an Advil and go to sleep…” the app will monitor everything for him. In the unlikely event that something is out-of-ordinary, the app will send John back to the smiling doctor.

Sounds like a dream comes true, isn’t it? Hold that thought for a minute.

Houston, We Have a (Critical) Problem

As we all know, hot/attractive areas, that benefit from high-demand and fast money (coming in), also attract charlatans. If you have no idea what I’m talking about, search for “Elizabeth Holmes” and you’ll have a good example what I’m referring to.

Theranos – the company that Elizabeth Holmes founded and managed – was thought to have revolutionized the old/simple/boring area of blood tests. At peak, the company was valued at $9 billion, after raising at least $724 million from investors along the years. As it turned out, the “revolution” the company claimed to create didn’t have much to do with testing the blood.

Think about it for a minute: If we chose a poor handyman who built a crooked wall, it is an unpleasant incident but certainly nothing more than a little damage to the bank account (and perhaps to the ego too). However, if we woke up with a crooked smile in the morning and the platform that checks our health parameters tells us (mistakenly) that everything is OK – that’s a whole different story.

The “what if the app is wrong, and we do suffer from a terminal illness” inevitable type of thinking is certain to keep John Doe coming to the clinic, no matter what.

Because digital platforms are sometimes wrong, or at least so most of us believe. Rightly or wrongly, it doesn’t really matter.

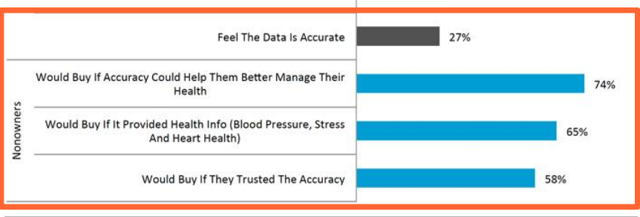

In a survey that took place in 2016 – involving 706 respondents, aged 18-65, in the US – regarding wearable equipment that is being used as a healthcare application, only 27% of the non-wearable users stated that they thought the information collected by the device was accurate.

Here is the summary of the results, based on the non-wearable owners’ answers:

The rest (vast majority) seem to think it’s much better/safer to go to the doctor. Human nature dictates that when it comes to our bodies, our health, and/or our lives – we’re way more skeptical. Healthcare-related innovative/digital solutions are being adopted at a much slower rate/pace than in other areas.

This (now, 3-year-old) survey doesn’t mean that healthcare innovation is “stuck;” quite the contrary! It is part of any normal-healthy cycle to kick out those who have nothing new/real to contribute, and it also gives a (much-needed) push for entrepreneurs to focus on new directions/developments, outside of the “home care” box.

Retail Clinic

This is another field that has been developing rapidly in recent years.

These clinics are located inside big-retail stores like Walmart (WMT) and Walgreens (WBA), and they are replacing the traditional/public clinics. Studies/surveys that measure the service and efficiency of these retail clinics show that this type of clinics offers better/speedier service.

If you come to a retail clinic straight after you have bought milk* at Walmart, it’s very unlikely that you’re going to sit with the doctor for half an hour, and it ensures that you’re going to be much more focused.

*Not a joke! A survey conducted among those who visited these clinics indicates that 68% bought something in the store before or after going to the clinic located in that very same store.

Average time spent at a traditional/regular clinic versus a retail clinic:

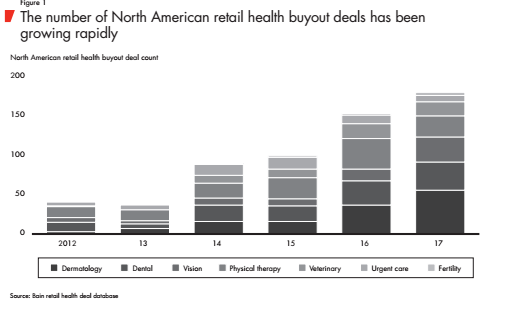

With more than 2,000 clinics already operating today and a steep growth, this much-needed “old service in a new package” type of business attracts investors.

According to Bain (another consulting company), in 2017 alone there were over 150 buyout deals that saw private equity firms taking over a network of retail clinics.

Why so much money is rushing in? Because this is a very solid-steady business, that offers EBITDA multiples of 7x-9x on a network with 10-50 clinics, and about 10x on a network with over 50 clinics.

Although the EBITDA rate is quite high, around 25%, leaving small room for much improvement, these private equity firms are no stupid and they still see a reasonable upside potential in the current market structure.

Bain also notes that the required, initial, large investment – about $200-300 thousand per clinic – is being covered, fairly quickly, as the network expands. Since the RoI is very high, the waiting time (for free cash flow) between consecutive investments is fairly short.

We are still far from scratching the growth potential of the private-retail health sector. There are still many exhausted doctors that some of their tasks can – and should – be outsourced from the public to the private-retail sector. A tired doctor is also someone who is more likely to make mistakes, so it’s a win-win for everybody – system, doctors, and patients alike.

And it does not stop here. Retail Healthcare also comes to kiosks across the US.

Why not offering for the same customers who buy cigarettes and chewing gum, a diagnostic test or a drug? They are already shopping and it may take seconds (!) to sell them another service, or product, on top of what they stopped by for. For example:

MedAvail has developed a device, looking like an ATM, that allows to obtain a prescription drug right away, without the need to go through a pharmacist and, of course, without waiting.

Why not sit down and relax for a minute, allowing an automated health station, developed by higi, to conduct various basic tests, resulting in an immediate feedback? Here is how it is:

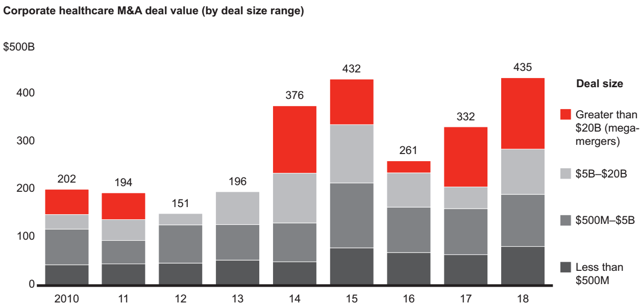

Record Health Deals (Since 2006)

You already get the picture: This field is boiling.

This is what happens when the structure of the market changes, and as the realization that the near future won’t be the same as the present.

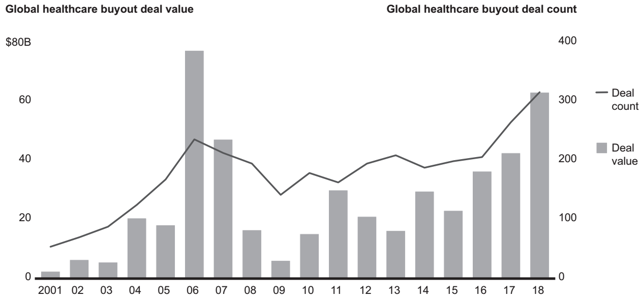

The value of healthcare buyout deals, worldwide, in 2018 was $63 billion. This is a number we haven’t seen since 2006.

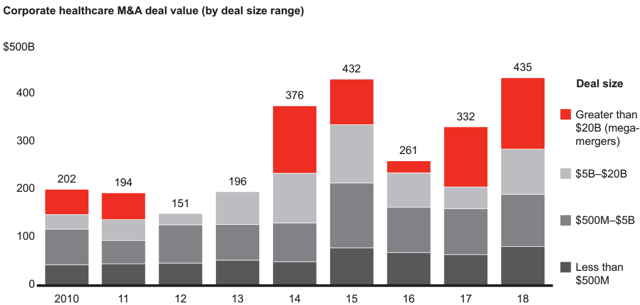

Corporate healthcare transactions have also reached a peak, with no less than $435 billion worth of deals in 2018 alone.

What is particularly interesting is the increase in large transactions – those that are north of $20 billion. This proves that it’s not just the general appetite that grows, but also the willingness to swallow companies that come with an expensive price tag.

New Era

It’s not considered “science fiction” anymore to assume that in a few years the majority of the population won’t need to pay a visit to a doctor, unless the machine/device/app tells you to do so.

Instead of the family, long-standing, friendly physician, we will get used to work with Dr. General Electric or Dr. Apple, who is likely to be in a position to give better, quicker, and more accurate diagnostics (especially for routine-standard issues/signs).

Having said that, the world is still skeptical when it comes to relying on an automated system to test one’s liver or spleen.

A small number of scams, such as Elizabeth Holmes’ blood tests, is enough to raise the levels of both anxiety and suspicion the next time we sit next to the healthcare station, located inside a near-by store.

At the end of the day, even when it comes to health services/products, the trends in this sector are similar to the trends we see in other, less sensitive, sectors. When a dramatic-exogenous change occurs in any industry – it creates a new wave of companies that think out of the box and bring something new to the arena, that cause us all to ask/wonder “how, the hell, no one thought about it before!?”

In the health market this mega-change started with the mobile phone. Today, you have an app for almost any “popular” organ that moves in (and sometimes outside of) our body. The app can check and monitor basically anything that the doctor does not have time or mood for.

Then, the penny dropped, and the realization that we don’t necessarily need someone with a white coat to touch us started to sink in. Now, you can easily obtain simple-routine services at the nearest Walmart store, or at the kiosk across the street.

Epilogue

The bottom line here is that the combination of healthcare and technology is creating some fascinating opportunities. It’s no wonder that Amazon (AMZN), Berkshire Hathaway (BRK.A, BRK.B) and JPMorgan (JPM) decided to form a joint venture aimed at providing healthcare services, while employing and developing technology-based solutions, at an affordable cost.

Another example that comes to mind is Medidata Solutions (MDSO), a company that is also operating within the Healthcare Technology industry. At the Wheel of FORTUNE we bought on three different occasions, at an average price of $63/share (6/12/2017, 12/26/2017, and 12/21/2018, as a result of a PUT option assignment). Last month, Dassault Systemes (OTCPK:DASTY) agreed to buy MDSO in a deal worth $5.8 billion.

Data by YCharts

The challenge is to identify opportunities like MDSO that are part of a major change that is happening in front of our eyes, in the way that many health-related services are being offered and consumed.

In the famous movie, Harry and Sally find out that it’s hard, perhaps impossible, for a man and a woman to ever truly remain as strictly platonic friends. Similarly, the healthcare (XLV) and technology (XLK) sectors are slowly but surely realizing that they may have much more in common than they ever thought or wished for.

The Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

Take advantage of the two-week free trial, and gain access to our:

- Monthly Review, where all trades are monitored.

- Trading Alerts. We don’t trade every day, but we issue one alert per trading day, on average.

- Model Portfolio, comprised of ETFs & CEFs; aiming at beating the S&P 500 performance.

- “Getting Ready For 2019,” a 19-part series, featuring our circa-100 top picks across eleven sectors plus eight segments.

Disclosure: I am/we are long MDSO, WBA, GE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.