ALBUQUERQUE, N.M. — Technology drives business across all industries, but especially in financial services.

“It’s a 24-hour, 7-day a week effort,” said Jason Wyatt, president-elect of the New Mexico Bankers Association and president and CEO of Western Commerce Bank in Carlsbad.

Not only do financial institutions want to provide their customers and members with easy access to their accounts and services, they also must protect their assets from cyber threats, he said.

“We rely on numerous people, third-party vendors, software, firewalls, technology, etc. Twenty years ago cyber risk did not exist. Today IT expense is one of the largest expenses a bank has, which includes cyber risk,” he said.

……………………………………………………….

Paul DiPaola, president of First State Bank, said, “We spend billions per year in new technology.” Security is a top priority especially as it couples with efficient new systems, like Zelle a secure money transfer service.

New all-digital small business lending has been launched across all platforms, as have tools for tracking financial goals, paying bills and transferring funds, he added. U.S. Bank has 275 employees and 31 branches across the state.

At First Financial Credit Union, new technology has informed the remodel and design of several branches.

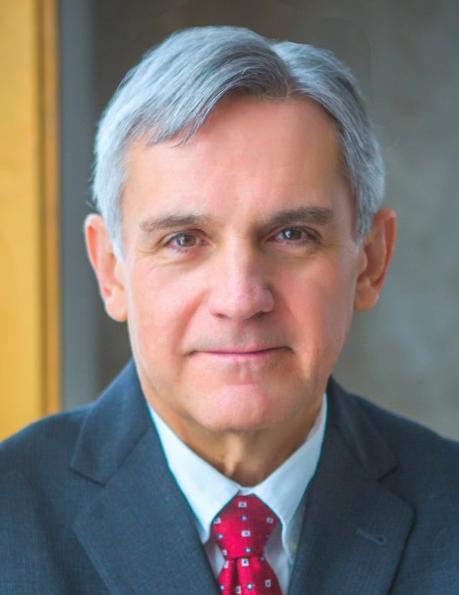

Ron Moorehead

“We don’t have to look like we are banks from the 1880s,” said Ron Moorehead, CEO of First Financial.

First Financial has more than 77,000 members and assets valued at more than $543 million.

Secure digital money delivery systems mean that tellers can come out of their cages and interact with members. Moorehead says the credit union has launched training programs so each teller can also provide members with customer service, if they need it without having to go through several lines.

Robert Chavez, president and CEO at Sandia Laboratory Federal Credit Union, said his credit union has launched a complete overhaul of its online and mobile banking in 2018 to make it more user-member-friendly than ever before. It offers more information, calculators, modules, podcasts and videos to keep members up to date.

Sandia Laboratory has more than 101,000 members and assets of $2.5 billion, according to its annual report.

……………………………………………………….

And it employs 17 people to monitor and build systems to protect members from cyber risks. Annual salaries for that group exceed $1 million, a year. The credit union spends more than $600,000 each year for security services and related cybersecurity hardware and software

Each employee also is tested and trained to respond to cyber risks for a training investment of $60,000, Chavez added.